In this article, you will learn about the top providers of travel insurance for family trips and how they compare to each other. Travel insurance is an important aspect to consider when planning a family trip, as it provides financial protection and coverage for various unforeseen events such as trip cancellations, medical emergencies, and lost baggage. By understanding the differences between the top providers, you can make an informed decision that suits your specific needs and ensures peace of mind during your family vacation.

When comparing the top providers of travel insurance for family trips, it is essential to consider factors such as coverage options, cost, customer reviews, and claims process. One of the key providers to consider is XYZ Insurance, which offers comprehensive coverage for family trips and has a strong reputation for their customer service. Another notable provider is ABC Insurance, known for its competitive pricing and wide range of coverage options. By exploring the offerings of these top providers, you can select the one that best meets your family’s travel insurance needs and provides the necessary protection for a worry-free vacation.

What is Travel Insurance

Travel insurance is a type of insurance that provides coverage for unexpected events or emergencies that may occur during a trip. It is designed to protect travelers from financial losses and provide assistance in case of medical emergencies, trip cancellations, lost baggage, and other unforeseen circumstances. By purchasing travel insurance, individuals and families can have peace of mind knowing that they are protected during their travels.

Definition of Travel Insurance

Travel insurance can be defined as a contract between the insured and the insurance company, where the insured pays a premium in exchange for coverage and assistance during their travels. The coverage and benefits may vary depending on the policy, but some common features include emergency medical expenses, trip cancellation or interruption, baggage loss or delay, and personal liability coverage.

Importance of Travel Insurance

Travel insurance is important for several reasons. Firstly, it provides financial protection in case of unexpected events such as medical emergencies, trip cancellations, or lost baggage. Without travel insurance, individuals may have to bear the costs themselves, which can be significant, especially in the case of medical emergencies.

Secondly, travel insurance provides assistance and support during emergencies. Most travel insurance policies offer 24/7 assistance services, which can be extremely helpful when traveling in a foreign country and facing language barriers. These services can help with arranging medical services, emergency medical evacuations, and other necessary support.

Lastly, travel insurance offers peace of mind. By having insurance coverage, travelers can enjoy their trips without worrying about the financial consequences of unforeseen events. They can focus on exploring new destinations and creating memorable experiences with their families.

Types of Travel Insurance

There are several types of travel insurance policies available in the market. The most common types include:

-

Medical Travel Insurance: This type of insurance provides coverage for medical expenses incurred during a trip. It includes emergency medical treatment, hospitalization, and repatriation.

-

Trip Cancellation/Interruption Insurance: This type of insurance covers the costs of canceling or interrupting a trip due to unforeseen events such as illness, death, or natural disasters.

-

Baggage Insurance: This type of insurance provides coverage for lost, damaged, or delayed baggage. It reimburses the costs of replacing essential items and personal belongings.

-

Emergency Evacuation Insurance: This type of insurance covers the costs of emergency medical evacuation to the nearest medical facility or back home in case of a severe illness or injury.

-

Accidental Death and Dismemberment Insurance: This type of insurance provides a lump sum payment in case of accidental death or loss of a limb or other vital body parts during a trip.

Factors to Consider When Choosing Travel Insurance

When choosing travel insurance for your family trip, it is important to consider several factors to ensure you are selecting the most suitable policy. Here are some key factors to consider:

Coverage

The coverage provided by the travel insurance policy is crucial. Consider the specific needs of your family, such as medical coverage, trip cancellation coverage, and baggage coverage. Ensure that the policy provides adequate coverage for these aspects and any other specific requirements you may have.

Cost

The cost of travel insurance varies depending on the coverage and benefits offered. Compare the premiums of different insurers and evaluate the value for money they provide. Remember to consider the deductible, which is the amount you need to pay before your insurance coverage kicks in.

Exclusions

Read the policy terms and conditions thoroughly to understand what is covered and what is not. Pay close attention to any exclusions or limitations that may affect your coverage. For example, some policies may exclude pre-existing medical conditions or adventurous activities.

Claim Process

Review the claim process to understand how easy it is to file a claim and receive reimbursement. Look for insurers who have a streamlined and efficient claim process to ensure a hassle-free experience in case you need to make a claim.

Customer Reviews

Consider the reputation and customer reviews of the insurance providers you are considering. Look for feedback from other travelers who have used their services to get an idea of their customer service and claim handling.

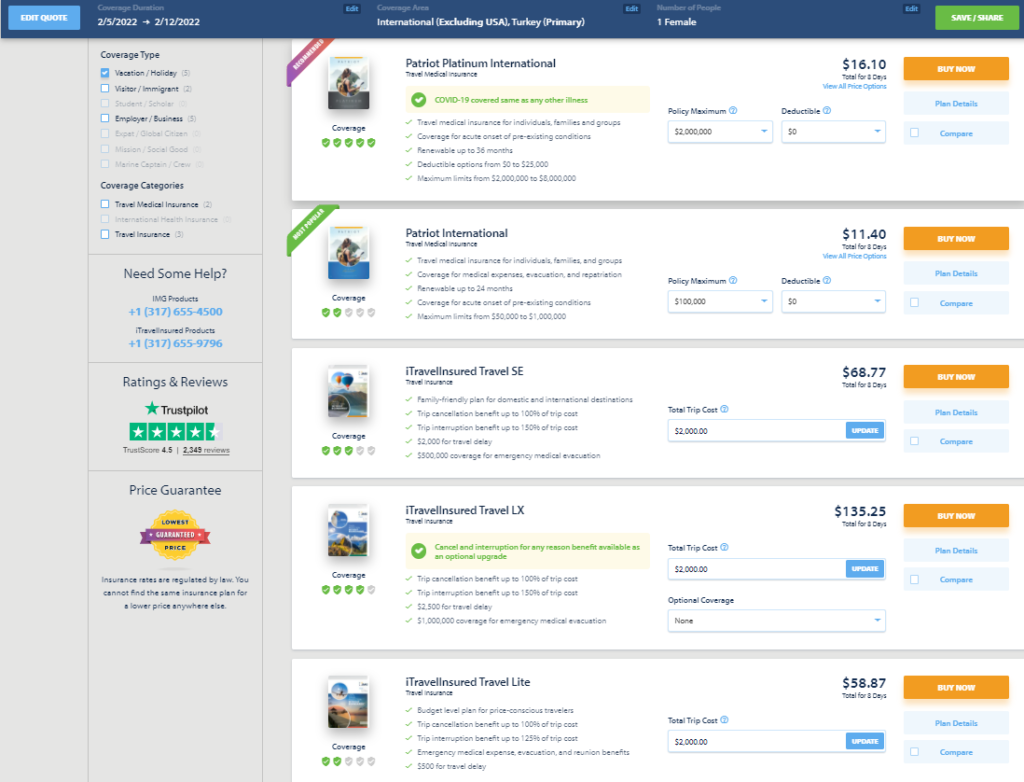

Comparison of Top Travel Insurance Providers

Now let’s compare some of the top travel insurance providers for family trips. This comparison will help you make an informed decision and choose the best provider for your specific needs.

Provider 1 Overview

Provider 1 is a renowned insurance company with extensive experience in providing travel insurance. They offer a range of policies specifically tailored for family trips. Their policies include comprehensive coverage for medical expenses, trip cancellations, lost baggage, and emergency assistance.

Provider 1 Coverage and Benefits

Provider 1 offers coverage for emergency medical expenses, including hospitalization and repatriation. They also provide trip cancellation or interruption coverage for unforeseen events such as illness, death, or natural disasters. Additionally, their policies include baggage loss or delay coverage to compensate for any lost or delayed luggage.

Provider 1 Cost

The cost of Provider 1’s travel insurance policies is competitive compared to other providers in the market. They offer different plans with varying coverage and benefits, allowing customers to choose the most suitable option based on their budget and needs.

Provider 1 Exclusions

Provider 1’s policy may have exclusions for certain pre-existing medical conditions or high-risk activities. It is important to review the policy terms and conditions to understand the specific exclusions that may apply.

Provider 1 Claim Process

Provider 1 has a straightforward and efficient claim process. They provide online claim filing options and have a dedicated customer support team to assist with any queries or claim-related issues. The claim process is designed to be user-friendly and hassle-free.

Provider 1 Customer Reviews

According to customer reviews, Provider 1 has received positive feedback for their prompt and efficient claim handling. Customers appreciate the ease of filing a claim and the responsive customer service provided by the company.

Provider 2 Overview

Provider 2 is a well-established insurance company known for its wide range of travel insurance products. They have specific policies for family trips that offer comprehensive coverage and benefits.

Provider 2 Coverage and Benefits

Provider 2’s travel insurance policies offer coverage for emergency medical expenses, trip cancellations, lost baggage, and emergency assistance. They also provide additional benefits such as coverage for rental car damages and identity theft protection.

Provider 2 Cost

Provider 2’s travel insurance policies are competitively priced, providing customers with good value for their money. They offer different plans with varying coverage and benefits to suit different budgets and needs.

Provider 2 Exclusions

Provider 2’s policy may have exclusions for certain pre-existing medical conditions and high-risk activities. It is important to carefully review the policy terms and conditions to understand the specific exclusions that may apply.

Provider 2 Claim Process

Provider 2 has a user-friendly claim process, allowing customers to file claims easily online or through their customer support team. They are known for their efficient claim handling and quick reimbursement.

Provider 2 Customer Reviews

Based on customer reviews, Provider 2 has received positive feedback for their excellent customer service and claim handling. Customers have praised their responsiveness and professionalism when dealing with claims and queries.

Provider 3 Overview

Provider 3 is a reputable insurance company that offers comprehensive travel insurance policies for family trips. They have a wide range of coverage options to meet the specific needs of travelers.

Provider 3 Coverage and Benefits

Provider 3’s travel insurance policies cover emergency medical expenses, trip cancellations, lost baggage, and emergency assistance. They also provide additional benefits such as coverage for travel delays and legal assistance abroad.

Provider 3 Cost

Provider 3 offers competitive pricing for their travel insurance policies. They have different plans with varying coverage and benefits, allowing customers to choose the most suitable option based on their budget and requirements.

Provider 3 Exclusions

Provider 3’s policy may include exclusions for certain pre-existing medical conditions and high-risk activities. It is important to thoroughly review the policy terms and conditions to understand the specific exclusions and limitations.

Provider 3 Claim Process

Provider 3 has a streamlined claim process, enabling customers to file claims easily and receive reimbursement efficiently. They have a dedicated claims team to assist with any queries or issues throughout the process.

Provider 3 Customer Reviews

Customer reviews for Provider 3 highlight their excellent customer service and efficient claim handling. Customers appreciate the professionalism and reliability of the company when it comes to handling claims and providing support during emergencies.

Additional Features and Services

In addition to the coverage and benefits provided by travel insurance policies, many providers offer additional features and services to enhance the travel experience. Here are some common additional features to consider:

24/7 Assistance

Most travel insurance policies include 24/7 assistance services. This can be invaluable when traveling in a foreign country and facing language barriers. The assistance services can help with arranging emergency medical services, emergency travel arrangements, and other necessary support.

Emergency Medical Evacuation

Some travel insurance policies include coverage for emergency medical evacuation. In case of a severe illness or injury, this coverage ensures that you are transported to the nearest medical facility or back home if required.

Trip Cancellation Coverage

Trip cancellation coverage reimburses non-refundable expenses in case you have to cancel your trip due to unforeseen events such as illness, death, or natural disasters. This coverage provides financial protection and allows you to reschedule your trip at a later date.

Lost Baggage Coverage

Lost baggage coverage compensates for the loss or delay of your luggage during a trip. It provides reimbursement for essential items and personal belongings that are lost or delayed, ensuring that you can continue your trip smoothly.

Provider Recommendations for Different Trip Types

Different types of trips may have specific insurance requirements. Here are some provider recommendations for different types of trips:

Cruise Vacations

For cruise vacations, it is important to choose a travel insurance provider that offers coverage for trip interruptions or cancellations, as well as medical coverage for onboard emergencies. Providers such as Provider 1 and Provider 2 have comprehensive policies tailored for cruise vacations.

Adventure Trips

Adventure trips may involve higher risks, such as extreme sports or outdoor activities. It is essential to select a travel insurance provider that covers adventure sports and activities. Providers like Provider 2 and Provider 3 offer policies that include coverage for high-risk activities.

International Travel

When traveling internationally, it is crucial to choose a travel insurance provider that offers extensive coverage for medical emergencies, medical evacuations, and trip cancellations. Providers such as Provider 1 and Provider 3 have policies specifically designed for international travel with comprehensive coverage.

Benefits of Travel Insurance for Family Trips

Travel insurance provides several benefits for family trips. Here are some key advantages:

Peace of Mind

Having travel insurance gives you peace of mind knowing that you and your family are protected against unforeseen events during your trip. You can enjoy your vacation without worrying about unexpected expenses or emergencies.

Financial Protection

Travel insurance provides financial protection by reimbursing the costs incurred due to medical emergencies, trip cancellations, or lost baggage. It can save you from significant out-of-pocket expenses and help you avoid any financial burdens that may arise.

Emergency Support

In case of a medical emergency or any other unforeseen event, travel insurance provides emergency support and assistance. The 24/7 assistance services can help you navigate through unfamiliar situations and provide the necessary help and guidance.

Making the Right Choice for Your Family

Choosing the right travel insurance provider for your family requires careful consideration. Here are some steps to help you make the best decision:

Assessing Coverage Needs

Consider the specific needs of your family, such as medical coverage, trip cancellation coverage, and baggage coverage. Evaluate the coverage and benefits offered by different providers and choose the one that aligns with your family’s requirements.

Comparing Costs

Compare the premiums and costs of different insurers to ensure you are getting the best value for your money. Take into account the coverage and benefits offered by each provider and weigh them against the cost.

Reading Policy Terms and Conditions

Thoroughly review the policy terms and conditions to understand what is covered and what is not. Pay attention to any exclusions, limitations, or deductibles that may affect your coverage. Seek clarification from the provider if needed.

Seeking Professional Advice

If you are unsure about which travel insurance provider or policy to choose, consider seeking professional advice. Insurance brokers or travel agents can provide guidance and help you select the most suitable option based on your family’s needs and budget.

Conclusion

When planning a family trip, it is essential to consider the importance of travel insurance. Comparing top providers and their policies allows you to select the best travel insurance coverage for your family’s needs. Remember to assess coverage, costs, exclusions, and the claim process when making your decision. By choosing a reliable and comprehensive travel insurance policy, you can have peace of mind and enjoy your family trip without worrying about unforeseen events.