In this article, you will learn about some family travel insurance add-ons that are worth considering for your next trip. These add-ons provide additional coverage and benefits to ensure that you and your family are well protected while traveling. By understanding the different options available, you can make an informed decision and choose the add-ons that best suit your needs and preferences.

One family travel insurance add-on worth considering is the coverage for pre-existing medical conditions. It is important to disclose any pre-existing conditions to your insurance provider when purchasing a policy, as some standard travel insurance policies may not cover them. By adding this coverage, you can have peace of mind knowing that medical expenses related to your pre-existing condition will be covered in case of emergencies or unforeseen circumstances. Another add-on to consider is the rental car coverage, which protects you in the event of damage or theft to a rental vehicle. This can save you from unexpected expenses and potential complications during your trip. Additionally, some travel insurance policies offer coverage for trip cancellation and interruption, giving you financial protection in case you need to cancel or cut short your trip due to unforeseen circumstances such as illness, natural disaster, or unexpected travel advisories.

Why Family Travel Insurance Add-ons are Important

As a responsible and savvy traveler, you understand the importance of having travel insurance to protect yourself and your loved ones during your trips. However, have you considered the need for family travel insurance add-ons? These additional coverages can provide extra protection specifically tailored for your family’s needs. In this article, we will explore the benefits of family travel insurance add-ons and discuss the various types available. By understanding the significance of these add-ons, you can ensure a worry-free and enjoyable family vacation.

Protection for Your Whole Family

One of the primary reasons why family travel insurance add-ons are essential is because they provide comprehensive protection for your entire family. When traveling with loved ones, it’s crucial to have coverage that extends to everyone, including children and elderly family members. Family travel insurance add-ons offer this comprehensive protection, ensuring that each family member is covered in case of any unforeseen events or emergencies.

Extra Coverage for Expensive Belongings

When you embark on a family vacation, you may bring along expensive items such as laptops, cameras, or smartphones. These belongings are not only valuable but also indispensable during your trip. Family travel insurance add-ons often include coverage for lost, stolen, or damaged belongings. This means that if any of your expensive items are lost or damaged during your journey, you can be reimbursed for their value. This extra coverage gives you peace of mind knowing that your valuable belongings are protected.

Peace of Mind in Emergencies

Traveling with your family means that unforeseen emergencies can become even more stressful. Family travel insurance add-ons offer peace of mind in these situations by providing additional coverage for emergencies. Whether it’s a medical emergency, trip interruption, or accident, these add-ons ensure that you and your family are protected and can receive the necessary assistance when you need it the most. You can travel with confidence, knowing that your loved ones are financially protected in case of any unforeseen emergencies.

Types of Family Travel Insurance Add-ons

Now that we understand the importance of family travel insurance add-ons, let’s explore the different types available. Each add-on serves a specific purpose and provides additional coverage for different travel-related scenarios. By understanding these types, you can choose the right combinations that suit your family’s needs.

Medical Evacuation Coverage

Medical evacuation coverage is one of the most critical add-ons for family travel insurance. It provides coverage for emergency transportation to the nearest suitable medical facility in case of a serious illness or injury. In situations where specialized treatment or medical attention is required, medical evacuation ensures that you and your family can access the necessary medical facilities even if they are not available locally. This coverage can be particularly essential when traveling to remote or underdeveloped areas where medical facilities may be limited.

Pre-existing Medical Conditions Coverage

If any family member has pre-existing medical conditions, it is crucial to select travel insurance add-ons that offer coverage specifically for these conditions. Pre-existing medical conditions coverage ensures that any unexpected complications related to pre-existing conditions are covered. This can include emergencies, hospital stays, and medical treatments that may arise due to these conditions while traveling. By having this coverage, you can avoid high medical costs and ensure your family’s health and well-being are prioritized during your trip.

Trip Cancellation or Interruption Coverage

Unexpected events, such as natural disasters, sudden illness, or family emergencies, can force you to cancel or interrupt your trip. Trip cancellation or interruption coverage reimburses you for the non-refundable expenses associated with your trip, such as airfare, accommodation, and tours. This coverage provides financial protection, ensuring that you don’t suffer a significant loss in case your trip needs to be canceled or cut short due to unforeseen circumstances. When traveling with family, this coverage becomes even more critical, as the financial repercussions can be substantial if you have to cancel or alter your plans.

Lost or Delayed Baggage Coverage

Lost or delayed baggage can be a frustrating experience, especially when traveling with your family. To avoid the inconvenience and stress caused by lost or delayed baggage, family travel insurance add-ons often include coverage for such situations. This coverage provides compensation for lost or stolen belongings and may also offer reimbursement for essential purchases during baggage delay. With this add-on, you can have peace of mind knowing that you and your family’s belongings are protected, and you won’t be left empty-handed during your trip.

Rental Car Collision Coverage

If you plan to rent a car during your family vacation, rental car collision coverage is an add-on that is worth considering. This coverage provides protection against damage or theft of the rental car. Rental car companies often offer their own insurance options, but they can be quite expensive. With rental car collision coverage as part of your travel insurance add-ons, you can avoid the high fees charged by rental car companies and still have the peace of mind of being insured while driving. This coverage is particularly important when traveling with your family, as it ensures their safety and financial protection in case of any damage or theft of the rental car.

Adventure Activities Coverage

If your family enjoys adventurous activities or plans to participate in any risky outdoor sports during your trip, adventure activities coverage should be on your radar. This add-on covers any accidents or injuries that may occur while engaging in these activities. Whether it’s skiing, hiking, or water sports, adventure activities coverage ensures that your family is financially protected in case of any mishaps. By having this coverage, you can enjoy your adventurous activities without worrying about the potential financial consequences of accidents or injuries.

Benefits of Medical Evacuation Coverage

Now that we have explored the different types of family travel insurance add-ons let’s dive deeper into their specific benefits. Starting with medical evacuation coverage, here are the advantages of having this add-on as part of your family travel insurance:

Quick and Efficient Emergency Transportation

In case of a medical emergency, time is of the essence. Medical evacuation coverage ensures that you and your family receive quick and efficient emergency transportation to the nearest suitable medical facility. Whether it’s by air or ground transportation, this coverage eliminates any delays in receiving proper medical attention. This quick response can be critical in situations where immediate medical intervention is required for a family member’s health and well-being.

Coverage for Costly Medical Repatriation

Sometimes, due to the severity of a medical condition or a family member’s desire to receive treatment closer to home, medical repatriation may be necessary. Medical evacuation coverage includes coverage for medical repatriation, which involves the transportation of a patient back to their home country for further treatment. Medical repatriation can be an expensive process, involving specialized medical equipment and arrangements. With medical evacuation coverage, you can ensure that the costs associated with medical repatriation are covered, providing financial relief during a challenging time.

Access to Medical Specialists

In certain medical emergencies or complex health conditions, access to specialized medical specialists becomes crucial. Medical evacuation coverage can provide assistance in arranging transportation to a medical facility where the required specialists are available. By having this coverage, you can have peace of mind knowing that your family will have access to the best medical expertise, even if it requires transportation to a different location. This ensures that your family receives the highest level of medical care in case of any health emergencies during your trip.

Importance of Pre-existing Medical Conditions Coverage

For families traveling with members who have pre-existing medical conditions, the significance of pre-existing medical conditions coverage cannot be overstated. Here are the reasons why this add-on is essential:

Protection for Existing Health Conditions

When you have family members with pre-existing medical conditions, it’s important to have coverage that specifically addresses these conditions. Pre-existing medical conditions coverage protects your family members by covering any medical emergencies, hospital stays, or treatments directly related to their pre-existing conditions. This ensures that they receive the necessary medical attention without incurring substantial out-of-pocket expenses or being denied coverage due to their existing health conditions.

Coverage for Unexpected Complications

Pre-existing medical conditions can sometimes lead to unexpected complications, especially in unfamiliar environments or during physically demanding activities while traveling. Pre-existing medical conditions coverage provides financial protection in case any unforeseen complications arise due to these conditions. Whether it’s an unexpected hospitalization or sudden deterioration in health, this coverage ensures that your family members receive the necessary medical care without being burdened by high medical expenses.

Avoidance of High Medical Costs

Medical costs can vary greatly depending on the destination. However, one thing remains consistent – healthcare can be expensive, especially when traveling abroad. Without pre-existing medical conditions coverage, your family members may be left with substantial medical bills. This add-on helps you avoid high medical costs by providing coverage for any medical treatment, consultations, or hospital stays that may be required due to pre-existing medical conditions. By having this coverage, you can prioritize your family’s health without worrying about the financial implications of medical expenses.

Advantages of Trip Cancellation or Interruption Coverage

Another crucial family travel insurance add-on is trip cancellation or interruption coverage. Here are the benefits of having this coverage:

Reimbursement for Cancelled or Interrupted Trips

Life is unpredictable, and unforeseen events can force you to cancel or interrupt your family vacation. Trip cancellation or interruption coverage provides reimbursement for the non-refundable expenses associated with your trip. Whether it’s the cost of airfare, accommodation, or tours, this coverage ensures that you don’t suffer a significant financial loss if your trip needs to be canceled or cut short due to unexpected circumstances. By having this add-on, you can protect your family’s vacation investment and avoid the stress of losing valuable prepaid expenses.

Coverage for Major Unforeseen Events

Certain unforeseen events, such as natural disasters, terrorism, or political unrest, can disrupt your travel plans. Trip cancellation or interruption coverage offers protection in these situations by reimbursing you for the non-refundable expenses associated with your trip. While these events are beyond your control, having this coverage allows you to mitigate the financial impact and potentially reschedule or plan a new family vacation at a later date without significant financial loss.

Financial Protection for Non-refundable Expenses

When planning a family vacation, you may book and pay for various non-refundable expenses in advance. These can include airfare, accommodation, tours, and activities. In case of trip cancellation or interruption, these non-refundable expenses can add up to a significant amount. Trip cancellation or interruption coverage ensures that you are financially protected by reimbursing you for these expenses. This allows you to reschedule or plan another trip in the future with minimal financial consequences.

Why Lost or Delayed Baggage Coverage is Essential

Losing your baggage or experiencing delays can be a stressful and inconvenient situation, especially when traveling with your family. Here’s why lost or delayed baggage coverage is essential:

Compensation for Lost or Stolen Belongings

When you travel with your family, you may have valuable belongings such as laptops, cameras, or jewelry. In case of lost or stolen baggage, lost or delayed baggage coverage provides compensation for these belongings. This coverage ensures that you are financially reimbursed for the value of the lost or stolen items. By having this coverage, you can replace your family’s lost belongings without bearing the entire financial burden.

Coverage for Delayed Baggage

Baggage delays can be incredibly frustrating, especially when essential items are stored in the delayed luggage. Lost or delayed baggage coverage includes compensation for delayed baggage, allowing you to purchase necessary items while waiting for your luggage to arrive. This coverage ensures that you don’t have to spend your vacation without the essentials, and you can be reimbursed for any essential purchases you need to make while waiting for your delayed baggage.

Reimbursement for Essential Purchases

In case of delayed baggage, you may need to purchase essential items such as clothing, toiletries, or medication. Lost or delayed baggage coverage provides reimbursement for these essential purchases. This ensures that you don’t have to bear the entire cost of replacing these items, providing financial relief and allowing you to enjoy your vacation without unnecessary stress. By having this coverage, you can focus on creating lasting memories with your family instead of worrying about the inconvenience caused by lost or delayed baggage.

Benefits of Rental Car Collision Coverage

If you plan to rent a car during your family vacation, rental car collision coverage is an add-on that you shouldn’t overlook. Here are its advantages:

Protection against Damage or Theft of Rental Cars

Accidents can happen, even when you’re a careful driver. Rental car collision coverage provides protection against any damage or theft of the rental car. If your rented vehicle is involved in an accident or is stolen, this coverage ensures that you are financially covered for the cost of repairs or replacement. By having rental car collision coverage, you can drive with peace of mind, knowing that you won’t be financially responsible for any damages that may occur to the rental car.

Avoidance of High Insurance Fees

When renting a car, rental car companies typically offer their own insurance options to cover any potential damages to the vehicle. However, these insurance options can be quite expensive and can significantly increase your overall rental expenses. By having rental car collision coverage as part of your family travel insurance, you can avoid the high insurance fees charged by rental car companies and still have comprehensive coverage for any rental car-related accidents or thefts. This allows you to save money while ensuring the safety and financial protection of your family during your road trips.

Peace of Mind while Driving

Driving in unfamiliar locations or countries can be intimidating, especially when you’re responsible for the safety of your family. Rental car collision coverage offers peace of mind while driving, knowing that you have insurance coverage in case of any accidents or thefts involving the rental car. By having this add-on, you can focus on exploring and enjoying your chosen destination without worrying about the potential financial consequences of any incidents that may occur on the road.

Importance of Adventure Activities Coverage

If your family enjoys adventurous activities or plans to engage in outdoor sports during your vacation, adventure activities coverage becomes crucial. Here’s why this add-on is significant:

Coverage for Risky Outdoor and Adventurous Activities

Participating in risky outdoor activities and adventurous sports can be exhilarating, but it also increases the chances of accidents or injuries. Adventure activities coverage provides financial protection in case of any mishaps while engaging in these activities. Whether it’s skiing, hiking, snorkeling, or bungee jumping, this coverage ensures that your family is covered for any medical expenses or emergency treatments that may arise due to these adventurous activities. By having this add-on, you can fully enjoy your family’s adrenaline-filled activities without worrying about the potential financial consequences.

Financial Protection in Case of Accidents

Accidents can happen, even during activities that seem relatively safe. Adventure activities coverage provides financial protection in case of accidents while engaging in risky outdoor activities. Whether it’s a minor injury or a more severe accident, this coverage ensures that your family members receive the necessary medical attention without having to bear the burden of high medical costs. By having this coverage, you can have peace of mind knowing that your family’s safety and well-being are prioritized during your adventure-filled vacation.

Flexibility for Thrill-seeking Families

If your family enjoys trying new activities and seeking adventure, having adventure activities coverage provides flexibility. Participating in thrilling activities often involves a certain level of risk, and many standard travel insurance policies may exclude coverage for these activities. By adding adventure activities coverage to your family travel insurance, you can pursue your adventurous spirit while still having comprehensive insurance coverage. This add-on allows you to explore new experiences with confidence, knowing that you and your family are protected even during high-risk activities.

Factors to Consider when Choosing Add-ons

When selecting family travel insurance add-ons, several factors should be taken into consideration. These factors will help you choose the right combination of add-ons that suit your family’s needs. Here are the essential factors to consider:

Travel Destinations and Activities

The destinations you plan to visit and the activities you intend to engage in should influence the selection of your add-ons. For example, if you’re traveling to a remote area with limited medical facilities, medical evacuation coverage becomes even more critical. Similarly, if you plan to participate in adventure sports, adventure activities coverage is a must. Consider the specific risks and challenges associated with your chosen destinations and activities to determine which add-ons are most relevant for your family’s travel needs.

Budget and Affordability

While it’s important to prioritize your family’s safety and well-being, it’s also essential to consider your budget and affordability when selecting add-ons. Different add-ons come with varying costs, and it’s essential to strike a balance between the coverage you need and what you can afford. Assess your budget and consider how much you are willing to spend on additional insurance coverage. By doing so, you can ensure that you have comprehensive coverage while staying within your budget.

Family’s Health and Medical Condition

The health and medical condition of your family members play a significant role in determining the necessary add-ons. If you or any family member has pre-existing medical conditions, ensuring adequate coverage for these conditions becomes a priority. Similarly, if any family members have a history of requiring medical treatment or are prone to accidents, it’s crucial to select add-ons that offer comprehensive coverage for emergencies, medical repatriation, or adventure activities. Assess the health and medical condition of your family members to understand the specific coverage needs that should be addressed through the add-ons you choose.

Personal Risk Tolerance

Everyone has a different level of risk tolerance, and this can influence the types of add-ons you opt for. Some families may prefer to have extensive coverage, even for the most unlikely scenarios, to minimize any potential risks. Others may choose to focus on add-ons that address their specific concerns or activities they plan to undertake during their trip. Consider your family’s risk tolerance and any specific worries or concerns you may have. By selecting add-ons that align with your risk tolerance, you can have peace of mind knowing that you have coverage that suits your comfort level.

Tips for Choosing the Right Add-ons

Choosing the right add-ons for your family travel insurance can be a daunting task. To help you navigate through the options, here are some tips to consider:

Assess Your Family’s Needs

Before selecting any add-ons, assess your family’s specific needs and requirements. Consider factors such as health conditions, travel destinations, and intended activities, and determine what type of coverage is most relevant for your family. By understanding your family’s needs, you can make informed decisions on which add-ons to prioritize.

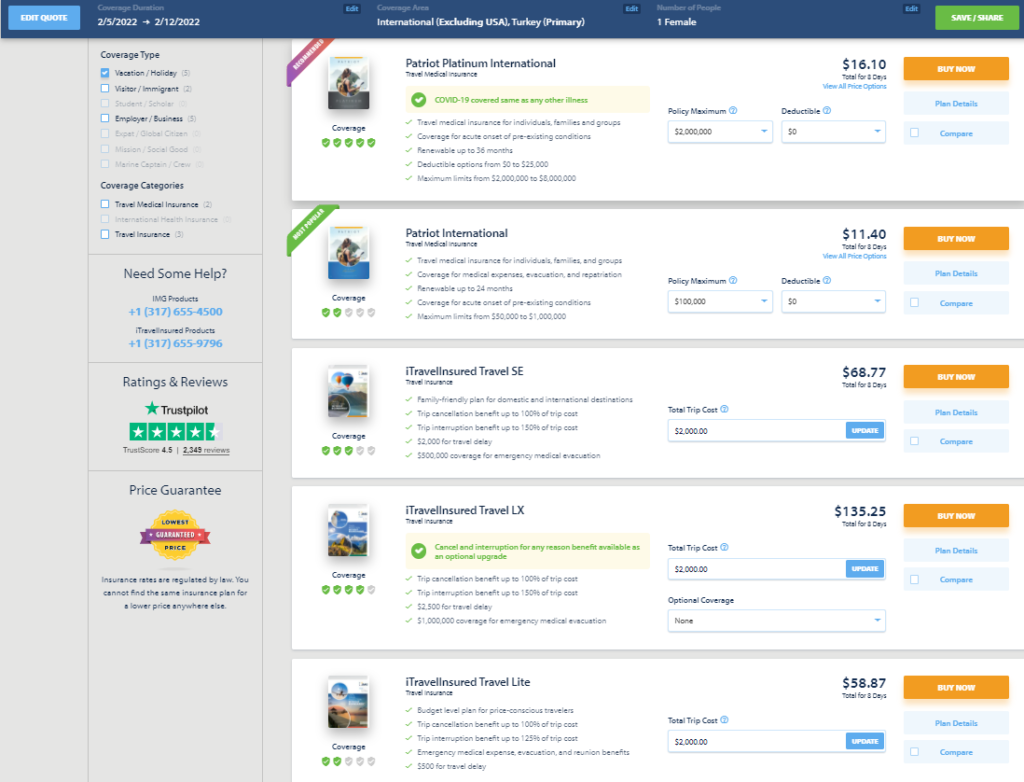

Research and Compare Options

Research different insurance providers and the add-ons they offer. Compare the coverage, benefits, and costs associated with each add-on. Pay attention to any additional terms and conditions or exclusions that may impact the add-ons’ effectiveness. By conducting thorough research and comparing options, you can make an informed decision based on the specific coverage you need and the affordability of the add-ons.

Read the Fine Print

When it comes to insurance, the fine print matters. Read the policy documents, terms and conditions, and any exclusions associated with the add-ons you are considering. Ensure that you have a clear understanding of what is covered and what is not. If you have any questions or doubts, reach out to the insurance provider or seek expert advice. By being well-informed about the details of the add-ons, you can avoid any surprises or misunderstandings during your travels.

Seek Expert Advice

If you are unsure about which add-ons to choose or have specific concerns or questions, seek expert advice. Consider consulting a trusted insurance agent or travel insurance specialist who can provide personalized guidance based on your family’s needs. These experts are knowledgeable about the complexities of travel insurance and can assist you in selecting the appropriate add-ons that align with your family’s specific requirements.

Common Mistakes to Avoid

As you navigate through the process of selecting family travel insurance add-ons, it’s important to be aware of common mistakes and pitfalls. Here are some mistakes to avoid:

Overlooking Coverage Limits and Exclusions

When choosing add-ons, don’t solely focus on the benefits or coverage provided. It’s equally important to pay attention to the coverage limits and exclusions associated with each add-on. Coverage limits define the maximum amount the insurance provider will reimburse, while exclusions specify the situations or conditions where the coverage does not apply. By overlooking these crucial details, you may end up with inadequate coverage or unexpected expenses during an emergency or unforeseen event.

Failing to Disclose Pre-existing Conditions

When applying for travel insurance and selecting add-ons, it’s imperative to disclose any pre-existing medical conditions accurately. Failing to disclose these conditions can result in denial of coverage or complications during the claims process. Provide complete and truthful information about any pre-existing conditions to ensure that you receive the appropriate coverage and avoid any potential issues later on.

Not Considering Additional Expenses

In addition to the cost of travel insurance and add-ons, it’s crucial to consider any additional expenses related to your chosen activities or destinations. For example, adventure activities coverage may protect against medical costs but may not cover potential equipment damage or loss. Factor in any additional expenses that may arise from the activities you plan to undertake and ensure that you have adequate coverage for all foreseeable risks and expenses.

Choosing Inadequate Coverage

One of the most common mistakes is choosing inadequate coverage due to budget constraints or misunderstanding of the add-on benefits. While it’s important to consider affordability, selecting add-ons solely based on cost and overlooking necessary coverage can leave you exposed to significant financial risks. Assess your family’s needs and prioritize the coverage that aligns with those needs. Opt for add-ons that provide comprehensive protection, even if it means adjusting your budget or opting for slightly higher coverage costs.

Conclusion

Family travel insurance add-ons provide valuable additional protection for your family during your trips. By considering the specific needs of your family and destinations, you can choose the right add-ons that offer the necessary coverage for your vacation. Ensure that you assess your family’s needs, research and compare options, and read the fine print to make informed decisions. Avoid common mistakes and ensure that you have comprehensive coverage in place for a worry-free and enjoyable trip with your loved ones. With the right family travel insurance add-ons, you can focus on creating priceless memories together while leaving any worries behind.