In this article, you will learn about family travel insurance and how to determine how much coverage is enough for your trip. Family travel insurance is an important aspect to consider when planning your vacation, as it provides financial protection against unexpected events that may disrupt or cancel your trip. By understanding how much coverage you need, you can ensure that you are adequately protected and have peace of mind while traveling with your family.

When determining how much coverage is enough for your family travel insurance, there are several factors to consider. Firstly, you should evaluate the cost of your trip, including transportation, accommodation, and activities. This will help you estimate the amount of coverage you will need in case of trip cancellation or interruption. Additionally, it is important to consider the medical coverage offered by the insurance policy, especially if you are traveling to a destination with high healthcare costs. By assessing these factors and considering any specific needs of your family, you can determine the appropriate amount of coverage for your family travel insurance.

What is family travel insurance?

Family travel insurance is a type of insurance policy that provides coverage for multiple family members traveling together. It offers protection against various unforeseen events such as medical emergencies, trip cancellations, lost baggage, and travel delays. It is designed to provide peace of mind and financial protection during family vacations.

Definition

Family travel insurance is a contract between the insured and the insurance provider, wherein the insurer agrees to cover certain expenses and risks associated with travel for a specified period of time. The policyholder pays a premium in exchange for the coverage provided by the insurance company. The coverage and benefits vary depending on the specific policy chosen by the insured.

Importance of family travel insurance

Family travel insurance is important for several reasons. Firstly, it provides medical coverage for any unexpected illnesses or injuries that may occur during the trip. This ensures that you and your family members can receive proper medical treatment without worrying about the high costs.

Secondly, family travel insurance offers protection against trip cancellations or interruptions. If you are forced to cancel or cut short your trip due to unforeseen circumstances such as illness, bereavement, or natural disasters, the insurance company will reimburse you for the non-refundable expenses.

Thirdly, family travel insurance covers lost baggage or personal belongings. If your luggage is lost, stolen, or damaged during the trip, the insurance company will provide compensation to help you replace your belongings. This can be particularly beneficial when traveling with valuable items such as cameras, laptops, or jewelry.

Finally, family travel insurance offers coverage for travel delays or missed connections. If your flight is delayed or you miss a connecting flight, the insurance company will reimburse you for any additional expenses incurred, such as accommodation, meals, or transportation.

Overall, family travel insurance provides financial protection and peace of mind, ensuring that you and your loved ones can enjoy your vacation without worrying about unexpected expenses or emergencies.

Types of coverage in family travel insurance

Family travel insurance offers various types of coverage to protect you and your family members during your trip. These include medical expenses, emergency medical evacuation, trip cancellation or interruption, lost baggage or personal belongings, and travel delay or missed connection.

Medical expenses

One of the key components of family travel insurance is coverage for medical expenses. This ensures that you are financially protected in the event of unexpected illnesses or injuries during your trip. The insurance company will cover the cost of medical treatments, hospitalization, medication, and doctor’s fees, up to the limits specified in the policy.

Emergency medical evacuation

In case of a medical emergency that requires transportation to a different location for better medical care, family travel insurance provides coverage for emergency medical evacuation. This can include expenses related to air ambulance services, medical repatriation, or transportation to the nearest medical facility capable of providing appropriate treatment.

Trip cancellation or interruption

Family travel insurance also protects you against trip cancellations or interruptions. If you are unable to take your trip or have to cut it short due to unforeseen circumstances such as illness, injury, death, natural disasters, or even work-related issues, the insurance company will reimburse you for the non-refundable expenses you have incurred, such as prepaid hotel reservations, airfare, or tour packages.

Lost baggage or personal belongings

When traveling with your family, there is always a risk of lost or damaged baggage. Family travel insurance provides coverage for lost baggage or personal belongings, ensuring that you are compensated for the value of your lost items. This can include reimbursement for essential items, clothing, and toiletries while waiting for your lost baggage to be retrieved or replaced.

Travel delay or missed connection

Family travel insurance also covers travel delays or missed connections. If your flight is delayed due to weather, mechanical issues, or other unforeseen circumstances, the insurance company will reimburse you for additional expenses such as accommodation, meals, and transportation. Similarly, if you miss a connecting flight due to a delay or cancellation of your initial flight, the insurance company will provide compensation for the costs incurred.

Having coverage for these types of events can greatly reduce the financial burden and inconvenience faced while traveling with your family.

Factors to consider when determining coverage

When selecting a family travel insurance policy, there are several factors to consider in order to determine the appropriate coverage for your needs. These factors include the number of family members, the destination of travel, the activities and adventure sports you plan to participate in, and the duration of your trip.

Number of family members

The number of family members covered under your insurance policy will affect the cost of the premium and the coverage limits. Some policies offer coverage for a specific number of family members, while others may allow you to add additional family members for an extra premium. It is important to consider the size of your family and ensure that all members are adequately covered.

Destination of travel

The destination of your travel plays a significant role in determining the coverage you need. Different countries have different healthcare systems, and the cost of medical treatment can vary greatly. It is important to consider the quality and accessibility of healthcare at your destination and ensure that your insurance policy provides adequate coverage for medical expenses in that specific location.

Activities and adventure sports

If you plan to participate in activities or adventure sports during your trip, it is important to check if these are covered under your insurance policy. Some policies may have exclusions or limitations for certain high-risk activities, such as skydiving, bungee jumping, or scuba diving. It is essential to read the policy documents carefully and check if you need to purchase additional coverage for such activities.

Travel duration

The duration of your trip will also influence the coverage you need. Some insurance policies have a maximum coverage period, after which you will no longer be covered. It is important to ensure that your policy covers the entire duration of your trip, especially if you plan to take an extended vacation or a long-term trip.

Considering these factors will help you determine the appropriate coverage for your family travel insurance policy and ensure that you are adequately protected during your trip.

Assessing medical coverage needs

When it comes to family travel insurance, one of the most important aspects to consider is the coverage for medical expenses. Medical emergencies can happen at any time, and being prepared with the right insurance coverage can save you from significant financial burden.

Comparing medical expenses in different countries

One factor to consider is the cost of medical treatment in the country you plan to visit. Healthcare costs can vary greatly from one country to another, and it is important to have an insurance policy that provides coverage for medical expenses based on the cost of healthcare at your destination.

For example, medical treatment in some countries can be significantly more expensive than in others. Without proper coverage, a medical emergency can quickly drain your finances and put you and your family in a difficult situation. It is important to choose a policy that provides adequate coverage for medical expenses, taking into account the healthcare costs at your destination.

Understanding exclusions and limitations

It is crucial to read the policy documents carefully and understand the exclusions and limitations related to medical coverage. Insurance policies may have certain exclusions, such as pre-existing conditions, which are not covered by the policy. It is important to be aware of any such exclusions and consider whether you need additional coverage for pre-existing conditions.

Additionally, insurance policies may have limitations on coverage for certain medical treatments or procedures. For example, some policies may limit coverage for elective surgeries or cosmetic procedures. Understanding these limitations will help you assess whether the policy provides sufficient coverage for your medical needs.

Pre-existing conditions

If you or any of your family members have pre-existing medical conditions, it is important to consider whether these conditions are covered by the insurance policy. Some policies may exclude coverage for pre-existing conditions, while others may offer coverage with certain conditions or limitations.

If you have pre-existing conditions that are not covered by your family travel insurance policy, it may be possible to purchase additional coverage specifically for those conditions. However, it is important to note that additional coverage for pre-existing conditions may come at an extra cost.

Maternity coverage

If you are planning to travel while pregnant or if you have a family member who is pregnant, it is essential to consider the maternity coverage provided by the insurance policy. Pregnancy-related complications or emergencies can occur during travel, and having the appropriate coverage can provide peace of mind.

Some insurance policies may offer coverage for pregnancy-related medical expenses, while others may have exclusions or limitations. It is important to understand the terms and conditions related to maternity coverage and ensure that you have sufficient coverage for any potential pregnancy-related emergencies during your trip.

Assessing your medical coverage needs is crucial when selecting a family travel insurance policy. By considering the cost of medical treatment in your destination country, understanding exclusions and limitations, and evaluating coverage for pre-existing conditions and maternity, you can determine the appropriate level of coverage for your family’s medical needs.

Choosing appropriate coverage for trip cancellation or interruption

In addition to medical coverage, a key aspect of family travel insurance is coverage for trip cancellation or interruption. Unexpected events can occur before or during your trip, forcing you to cancel or cut short your vacation. Having the appropriate insurance coverage can help protect your financial investment.

Understanding trip cancellation reasons

When selecting a family travel insurance policy, it is important to understand the reasons for trip cancellation that are covered. Different insurance policies may have different cancellation reasons covered, and it is essential to ensure that the reasons most relevant to your trip are included.

Common covered reasons for trip cancellation include illness, injury, or death of the insured or immediate family member, natural disasters, terrorist attacks, and work-related issues. It is important to carefully read the policy documents and check if the reasons that are most likely to affect your trip are included in the covered reasons for cancellation.

Reimbursement limits and conditions

When it comes to trip cancellation or interruption, it is crucial to review the reimbursement limits and conditions set by the insurance policy. Insurance companies may have different limits on the amount of reimbursement they provide for cancelled or interrupted trips.

For example, some policies may reimburse up to a certain percentage of the total trip cost, while others may have a fixed dollar amount. It is important to assess whether the reimbursement limits offered by the policy are sufficient to cover your non-refundable expenses, such as airfare, hotel reservations, or tour packages.

Reviewing the fine print

It is essential to carefully review the fine print of the insurance policy to understand the terms and conditions related to trip cancellation or interruption. This includes understanding any applicable deductibles, the documentation required to support your claim, and the process for filing a claim.

Some insurance policies may require supporting documentation, such as a doctor’s note for an illness-related cancellation or a death certificate for a cancellation due to a death in the family. Understanding these requirements and ensuring that you have the necessary documentation can help expedite the claims process and ensure that you receive the reimbursement you are entitled to.

By carefully evaluating the covered reasons for trip cancellation, understanding the reimbursement limits and conditions, and reviewing the fine print, you can choose the appropriate coverage for trip cancellation or interruption that suits your family’s needs.

Determining coverage for lost baggage or personal belongings

When traveling with your family, the risk of lost or damaged baggage is always present. Family travel insurance provides coverage for lost baggage or personal belongings, ensuring that you are financially protected in case of such unfortunate events.

Valuable items and their coverage

If you are traveling with valuable items such as cameras, laptops, or jewelry, it is important to understand the coverage provided by the insurance policy. Some policies may have limits on the coverage for high-value items, and it is essential to check if those limits are sufficient to cover the value of your belongings.

For items that exceed the coverage limits of the insurance policy, you may have the option to purchase additional coverage specifically for those high-value items. This will ensure that you are adequately protected in case of loss, theft, or damage to your valuable belongings.

Submitting proper documentation

In the unfortunate event of lost or damaged baggage, it is important to submit proper documentation to support your claim. This may include a baggage claim form provided by the airline or transportation company, proof of ownership or purchase of the lost or damaged items, and any other relevant documentation.

Submitting proper documentation is crucial in order to receive reimbursement from the insurance company. It is advisable to keep copies of important documents, such as receipts for valuable items, as they can help expedite the claims process and ensure a smooth reimbursement.

Claims process

Understanding the claims process is essential when selecting a family travel insurance policy. Familiarize yourself with the procedures for filing a claim, the documentation required, and the timeline for claims processing. Some insurance companies may have specific guidelines or forms to be filled out, while others may require you to submit your claim online or via email.

It is important to ensure that you have all the necessary information and documentation readily available in case you need to file a claim. This will help streamline the claims process and ensure that you receive timely reimbursement for your lost or damaged baggage.

Determining the appropriate coverage for lost baggage or personal belongings involves understanding the coverage limits, submitting proper documentation, and being familiar with the claims process. By carefully considering these factors, you can choose a family travel insurance policy that adequately protects your belongings during your trip.

Considering coverage for travel delay or missed connection

Travel delays and missed connections can cause inconvenience and additional expenses while traveling with your family. Family travel insurance can provide coverage for these situations, ensuring that you are financially protected and able to overcome any potential costs and inconveniences.

Benefits of travel delay coverage

Travel delay coverage provides reimbursement for additional expenses incurred due to a delay in your travel plans. This can include costs such as accommodation, meals, transportation, and even necessary phone calls or internet access.

If your flight is delayed due to weather conditions, mechanical issues, or other unforeseen circumstances, travel delay coverage can help alleviate the financial burden and ensure that you and your family are taken care of during the delay.

Conditions for missed connection coverage

Missed connection coverage provides reimbursement for expenses incurred due to a missed connecting flight. If your initial flight is delayed or cancelled, causing you to miss your connecting flight, the insurance company will reimburse you for the additional costs associated with rebooking flights, accommodation, meals, and any other necessary expenses.

However, it is important to note that missed connection coverage is usually subject to certain conditions. For example, you may be required to provide proof that the delay or cancellation of your initial flight was beyond your control. It is important to understand the specific conditions outlined in the insurance policy and ensure that you meet the requirements for reimbursement.

Potential costs and inconveniences

Travel delays and missed connections can result in various costs and inconveniences. These can include the need for last-minute accommodation, meals, transportation, and other unexpected expenses. Without the appropriate insurance coverage, these costs can quickly add up and put a strain on your travel budget.

By considering coverage for travel delays and missed connections, you can ensure that you are financially protected and able to overcome any unexpected costs or inconveniences that may arise during your trip.

Customizable coverage options

Family travel insurance policies often offer customizable coverage options to suit your specific needs. These additional coverage options can provide enhanced protection for certain situations or high-value items that may not be covered under standard policies.

Additional coverage for specific needs

If you have specific concerns or needs that are not covered by standard family travel insurance policies, it is worth considering additional coverage options. For example, if you are planning to engage in high-risk activities or adventure sports during your trip, you may need to purchase additional coverage specifically for those activities.

Similarly, if you have specific medical conditions or concerns that are not covered by the standard policy, you can often purchase supplementary coverage to ensure that your needs are met. It is important to discuss your specific requirements with the insurance provider and explore the available options for additional coverage.

Enhanced protection for high-value items

If you are traveling with high-value items such as expensive electronics, jewelry, or designer clothing, it may be worthwhile to purchase enhanced protection for these items. Standard coverage limits may not be sufficient to fully reimburse you for the value of these items in case of loss, theft, or damage.

By adding enhanced protection for high-value items, you can ensure that you are adequately protected and receive fair compensation in case of any unfortunate incidents involving your valuable belongings.

Sports equipment coverage

If you plan to travel with sports equipment such as bicycles, skis, or golf clubs, it may be necessary to purchase additional coverage specifically for these items. Standard family travel insurance policies may exclude coverage for such specialized equipment or have limitations on the reimbursement amount.

Sports equipment coverage can provide protection against loss, theft, or damage to your gear, ensuring that you are able to enjoy your favorite activities while on vacation without worrying about the financial implications of any mishaps.

Customizable coverage options allow you to tailor your family travel insurance policy to your specific needs and concerns. By exploring these options and discussing your requirements with the insurance provider, you can create a policy that provides comprehensive coverage for your family’s unique travel experiences.

Comparing family travel insurance plans

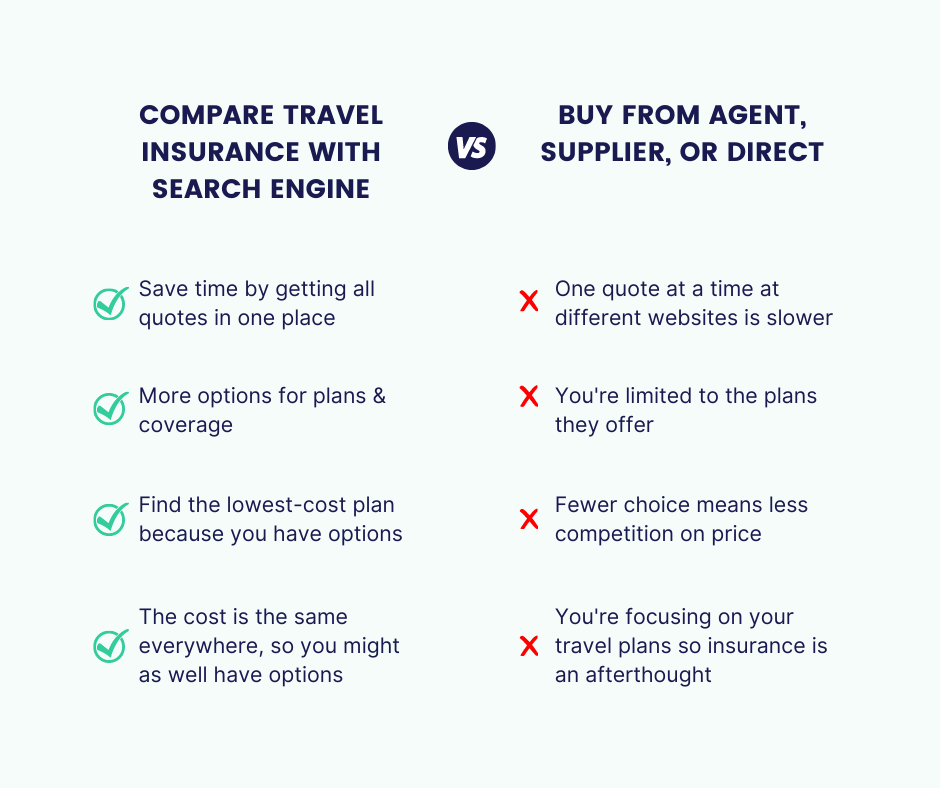

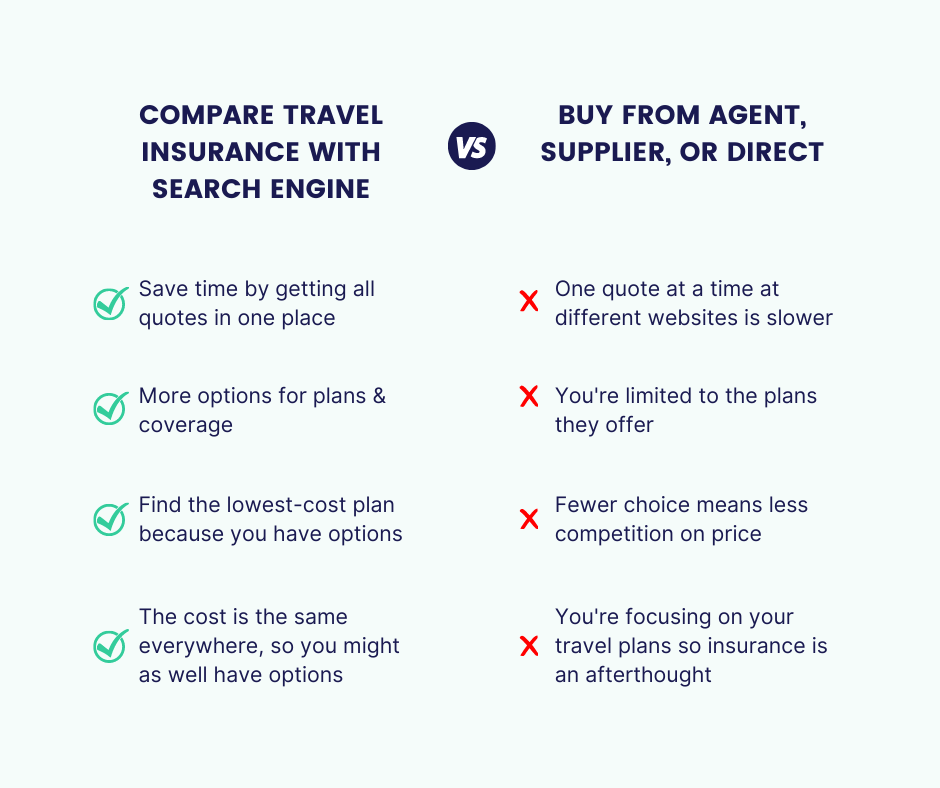

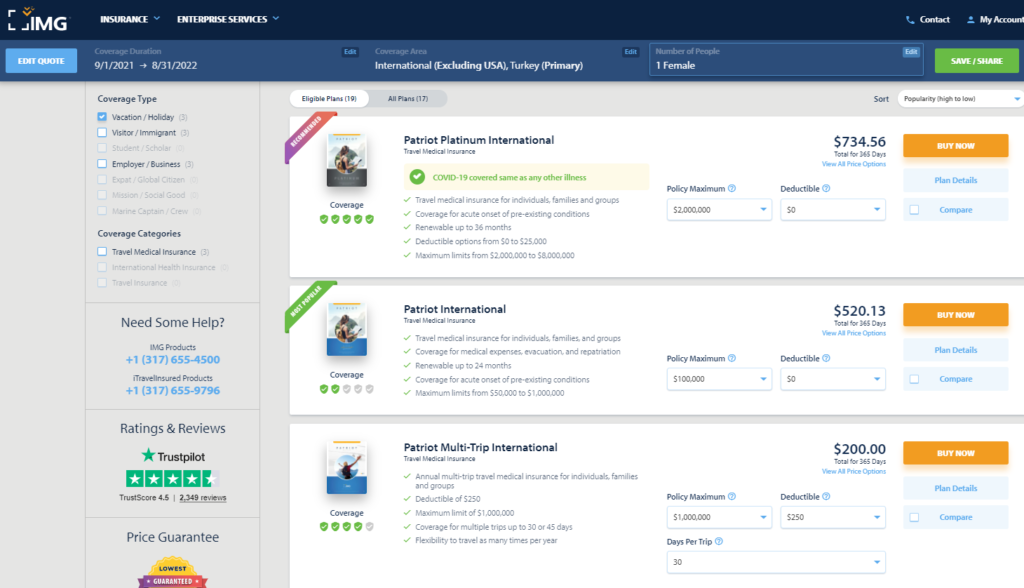

When it comes to family travel insurance, it is important to research and compare different insurance providers and their policies. This allows you to make an informed decision and choose the plan that best suits your family’s needs.

Researching different insurance providers

Start by researching different insurance providers that offer family travel insurance. Look for reputable companies with a history of providing quality coverage and excellent customer service. Online reviews and customer testimonials can provide valuable insights into the experiences of other people who have used their services.

Comparing coverage limits and premiums

Once you have identified a few potential insurance providers, compare the coverage limits and premiums offered by each. Consider the specific coverages you need for medical expenses, trip cancellation or interruption, lost baggage or personal belongings, and travel delay or missed connection. Check if the limits are sufficient for your family’s needs and compare the premiums to ensure that you are getting the best value for your money.

Reading customer reviews

Reading customer reviews can give you a sense of the level of customer satisfaction with a particular insurance provider. Look for reviews that highlight positive experiences with claims processing, customer support, and overall satisfaction with the coverage provided.

However, it is important to keep in mind that reviews can be subjective and may not reflect your own experience. Use them as a guideline but make sure to also evaluate the reputation and financial stability of the insurance provider.

By thoroughly researching and comparing different insurance providers, their coverage limits, and premiums, you can make an informed decision and choose a family travel insurance plan that provides comprehensive coverage at a competitive price.

Factors affecting the cost of family travel insurance

The cost of family travel insurance can vary depending on several factors. Understanding these factors can help you determine the potential cost of your insurance policy and budget accordingly.

Age of family members

The age of family members is a significant factor in determining the cost of family travel insurance. Older individuals are generally considered to be at a higher risk of medical issues, which can result in higher premiums. Some insurance providers may offer specific coverage options for older travelers, while others may apply age-based restrictions or higher premiums.

Additionally, some policies may offer discounts for children or infants traveling with their parents. It is important to inquire about age-related considerations and discounts when obtaining quotes for family travel insurance.

Destination

The destination of your travel can also impact the cost of family travel insurance. Some countries have higher healthcare costs or higher risks of natural disasters or political instability, which can result in higher insurance premiums. It is important to provide accurate information regarding your destination when obtaining insurance quotes to ensure that you receive an accurate cost estimate.

Coverage limits and deductibles

The coverage limits and deductibles selected for your insurance policy will affect the overall cost of family travel insurance. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage limits and higher deductibles reduce the premiums.

When selecting coverage limits and deductibles, it is important to strike a balance between the level of protection you desire and the cost of the insurance. Evaluating the potential risks and considering your budget will help you determine the appropriate coverage and deductibles for your family travel insurance policy.

Factors such as the age of family members, the destination of travel, and the coverage limits and deductibles selected will affect the cost of family travel insurance. By considering these factors and obtaining quotes from different insurance providers, you can determine the potential cost of your policy and select coverage that fits your needs and budget.

Tips for saving on family travel insurance

Family travel insurance is an important investment, but it doesn’t have to break the bank. By following these tips, you can save money on your family travel insurance premiums without compromising on the level of coverage.

Bundle insurance policies

One way to save on family travel insurance is to bundle it with other insurance policies you may already have, such as home or auto insurance. Many insurance providers offer discounts or reduced premiums when you bundle multiple policies with them. Be sure to inquire about such discounts when obtaining quotes for family travel insurance.

Consider annual plans

If your family travels frequently, it may be more cost-effective to consider an annual family travel insurance plan instead of purchasing separate policies for each trip. Annual plans typically provide coverage for multiple trips taken within a 12-month period. These plans can offer significant savings compared to purchasing separate policies for each trip.

Shop around for discounts

When researching and comparing insurance providers, be sure to inquire about any discounts they may offer. Some insurance companies offer discounts for various reasons, such as having a good claims history, being a member of certain organizations or affiliations, or purchasing your policy online.

Take the time to shop around and compare quotes from multiple insurance providers to find the best discounts available. Keep in mind that the cheapest policy may not always provide the best coverage, so it’s important to find the right balance between cost and coverage.

By bundling insurance policies, considering annual plans, and shopping around for discounts, you can save money on your family travel insurance premiums and still ensure that you have adequate coverage for your trips.

Understanding exclusions and limitations

When it comes to family travel insurance, it is important to understand the exclusions and limitations of the policy. This will help you make informed decisions and ensure that you are not caught off guard by any unexpected gaps in coverage.

Common exclusions

Insurance policies often have specific exclusions, which are situations or events that are not covered by the policy. Some common exclusions in family travel insurance policies include pre-existing conditions, high-risk activities or adventure sports, and acts of war or terrorism.

It is important to carefully read the policy documents and understand the exclusions before purchasing a family travel insurance policy. This will help you assess whether the policy provides coverage for your specific needs and consider purchasing additional coverage if necessary.

Policy limitations

Insurance policies may also have limitations on the coverage they provide. For example, a policy may have limits on the amount of reimbursement for medical expenses, trip cancellation or interruption, or lost baggage. It is important to review these limitations and ensure that they meet your family’s needs.

Additionally, some policies may have waiting periods before certain coverages become effective. For example, coverage for pre-existing conditions may have a waiting period during which any related expenses will not be covered. Understanding these limitations will help you plan accordingly and mitigate any potential gaps in coverage.

Reading the fine print

The fine print of the insurance policy contains important information about exclusions, limitations, and conditions. It is crucial to read this carefully and ask any questions you may have before purchasing the policy.

The fine print will also outline the specific requirements for filing a claim, including the documentation needed and the timeline for submitting the claim. It is important to familiarize yourself with these requirements and ensure that you are able to meet them in case you need to file a claim.

Understanding the exclusions, limitations, and conditions of your family travel insurance policy is essential to ensure that you have adequate coverage and to avoid any surprises or gaps in coverage. By reading the policy documents carefully and asking any necessary questions, you can obtain a clear understanding of the coverage provided and make informed decisions.

Importance of reviewing and updating coverage

Once you have obtained a family travel insurance policy, it is important to regularly review and update your coverage. Life circumstances can change, and your insurance needs may evolve over time. By reviewing and updating your coverage, you can ensure that you have adequate protection for your family’s travel experiences.

Regularly assessing coverage needs

Family travel insurance needs can change over time. As your family grows, you may need to add more members to the policy. If you have a pre-existing medical condition or if you are planning to engage in high-risk activities during your trip, your coverage needs may also change.

It is important to regularly assess your coverage needs and consider whether any adjustments need to be made. This can include increasing coverage limits, adding additional coverage for specific needs, or exploring additional options for enhanced protection.

Updating information and beneficiaries

Life circumstances can change, and it is important to keep your insurance provider informed of any changes in your personal information or beneficiaries. This includes updating your contact information, providing any changes in health conditions, and making sure that your beneficiaries are up to date.

By keeping your information up to date, you can ensure that the insurance company can reach you in case of emergencies and that your policy benefits will be distributed to the correct beneficiaries.

Renewing policies

Family travel insurance policies generally have a specific coverage period, after which the policy needs to be renewed. It is important to keep track of the renewal date and ensure that your policy is renewed on time. Failing to renew your policy can result in a lapse in coverage, leaving you and your family unprotected during your travels.

By regularly reviewing and updating your coverage, updating your personal information and beneficiaries, and renewing your policies on time, you can ensure that your family travel insurance provides ongoing protection and peace of mind.

Conclusion

In conclusion, family travel insurance is a crucial investment when planning a vacation with your loved ones. It provides financial protection and peace of mind, ensuring that you are prepared for any unexpected events or emergencies that may occur during your trip.

When determining the appropriate coverage, consider factors such as the number of family members, the destination of travel, the activities and adventure sports you plan to engage in, and the duration of your trip. Assessing your medical coverage needs, considering coverage for trip cancellation or interruption, lost baggage or personal belongings, and travel delay or missed connection, will help you select the right policy for your family.

Be sure to review and compare different insurance providers, understand the exclusions and limitations of the policy, and update your coverage regularly to ensure that it meets the changing needs of your family. By following these guidelines and taking the time to research and compare policies, you can find the family travel insurance coverage that provides the right level of protection for your family’s needs.

Remember, when it comes to family travel, having adequate insurance coverage is essential for a worry-free and enjoyable vacation. Don’t underestimate the importance of family travel insurance – it truly is a small investment that can make a big difference when it comes to protecting your loved ones and your travel investments.