In this article, you will learn some valuable tips for choosing the right family travel insurance plan. Travel insurance is an important consideration when planning a trip, especially when you have your family with you. By selecting the right plan, you can ensure that you have the necessary coverage in case of any unexpected events or emergencies during your travels.

When choosing a family travel insurance plan, it is important to consider the specific needs and requirements of your family. Look for a plan that provides coverage for all family members, including children, and offers comprehensive benefits such as medical coverage, trip cancellation or interruption, and baggage loss or delay. It is also important to review the exclusions and limitations of the plan to make sure it aligns with your family’s travel needs. By taking the time to research and compare different plans, you can find the right family travel insurance that provides peace of mind and protection during your journey.

Understanding Family Travel Insurance

Family travel insurance is a type of insurance coverage that provides protection and financial assistance to families when they travel together. It is designed to safeguard against unexpected events, such as accidents, illnesses, lost luggage, and trip cancellations, that may occur during the trip. By purchasing family travel insurance, you can have peace of mind knowing that you and your loved ones are protected in case of any unforeseen circumstances.

Why is Family Travel Insurance Important?

Family travel insurance is important for several reasons. Firstly, it provides financial protection in the event of unexpected medical emergencies that may occur while traveling. Medical expenses can be extremely costly, especially in foreign countries where healthcare services can be quite expensive. By having travel insurance, you can ensure that your family’s medical expenses are covered, allowing you to focus on getting the necessary care without worrying about the financial burden.

Secondly, family travel insurance also offers coverage for trip cancellation or interruption. If, for any reason, you need to cancel or cut short your trip, travel insurance can help reimburse you for the non-refundable expenses you have already incurred, such as flights, accommodation bookings, and tour packages. This can be particularly beneficial for families who have spent a significant amount on their travel plans and would like to protect their investment.

Additionally, family travel insurance provides coverage for lost or stolen baggage and personal belongings. Losing your luggage can be a major inconvenience, especially if it contains valuable items or essential belongings. With travel insurance, you can be reimbursed for the cost of replacing the lost items, allowing you to continue your trip without disruption.

Furthermore, family travel insurance may also offer coverage for travel delays and missed connections. If your flight is delayed or you miss a connecting flight due to unforeseen circumstances, such as inclement weather or mechanical issues, travel insurance can provide reimbursement for additional expenses incurred, such as accommodation, meals, and transportation.

Lastly, family travel insurance can provide coverage for political or natural disasters. If your travel plans are disrupted or canceled due to civil unrest, terrorism, or natural disasters, such as hurricanes or earthquakes, travel insurance can offer financial assistance to help you recover some of the costs and make alternative arrangements.

Factors to Consider When Choosing a Family Travel Insurance Plan

When selecting a family travel insurance plan, it is important to carefully consider various factors to ensure that you choose the right coverage for your specific needs. Here are some key factors to consider:

Coverage

One of the most important factors to consider is the coverage provided by the insurance plan. It is essential to review the policy to determine what types of risks and events are covered. Look for comprehensive coverage that includes medical expenses, trip cancellation, baggage loss, travel delays, and other essential aspects of travel insurance.

Pre-existing conditions

If any family member has pre-existing medical conditions, it is crucial to check if the insurance plan covers these conditions. Some plans may exclude pre-existing conditions, while others may offer coverage for an additional premium. Make sure to disclose any pre-existing conditions accurately to avoid potential claims denial.

Medical expenses

Review the policy’s coverage for medical expenses, including emergency medical treatment, hospitalization, and medication costs. Check the coverage limits and ensure they are sufficient for the countries you plan to visit, as healthcare costs can vary significantly worldwide.

Emergency medical evacuation

Emergency medical evacuation coverage is particularly important when traveling to remote areas or countries with limited healthcare facilities. This coverage ensures that you and your family can be safely transported to a suitable medical facility in the event of a serious illness or injury.

Trip cancellation

Carefully review the trip cancellation coverage to understand the circumstances under which you can receive reimbursement for non-refundable expenses. Look for coverage that includes trip cancellation due to unforeseen events, such as illness, injury, or death of a family member, or natural disasters.

Baggage and personal belongings

Check the coverage for lost or stolen baggage and personal belongings. Ensure that the coverage limits are sufficient to replace valuable items and that any valuable belongings are specifically listed in the policy.

Travel delays and missed connections

Verify the coverage for travel delays and missed connections, including coverage for additional expenses incurred during the delay. Look for coverage that provides reimbursement for expenses such as accommodation, meals, and transportation.

Political or natural disaster coverage

If you are traveling to regions prone to political unrest or natural disasters, it is important to consider the coverage for these events. Ensure that the insurance plan provides adequate coverage and assistance in the event of trip cancellations or disruptions due to political or natural disasters.

Adventure activities coverage

If your family enjoys engaging in adventurous activities, such as skiing, scuba diving, or hiking, make sure that the insurance plan covers these activities. Some plans may exclude coverage for certain high-risk activities, so it is essential to review the policy details.

Exclusions and limitations

Carefully read the policy documents to understand the exclusions and limitations of the insurance plan. Pay close attention to any conditions under which the coverage may be voided or reduced, and ensure that you comply with all requirements, such as obtaining necessary vaccinations or adhering to travel advisories.

Claims process

Evaluate the ease and efficiency of the insurance provider’s claims process. Look for reviews and ratings regarding the insurer’s claims handling and customer service, as this can significantly impact your experience in the event of a claim.

Customer reviews and ratings

Consider researching and reading reviews and ratings of different insurance providers to gain insight into the experiences of other customers. This can help you assess the reliability and reputation of the insurance company and make an informed decision.

Analyzing the Coverage

Before purchasing a family travel insurance plan, it is important to analyze your coverage needs to ensure that the plan adequately addresses your requirements. Here are some factors to consider when analyzing the coverage:

Determining the Coverage Needs

Consider the destinations you plan to visit, the activities you will engage in, and the duration of your trip. Assess the potential risks and hazards associated with your travel plans and determine the level of coverage required to mitigate those risks. For example, if you are traveling to a remote area with limited medical facilities, you may need higher coverage for emergency medical evacuation.

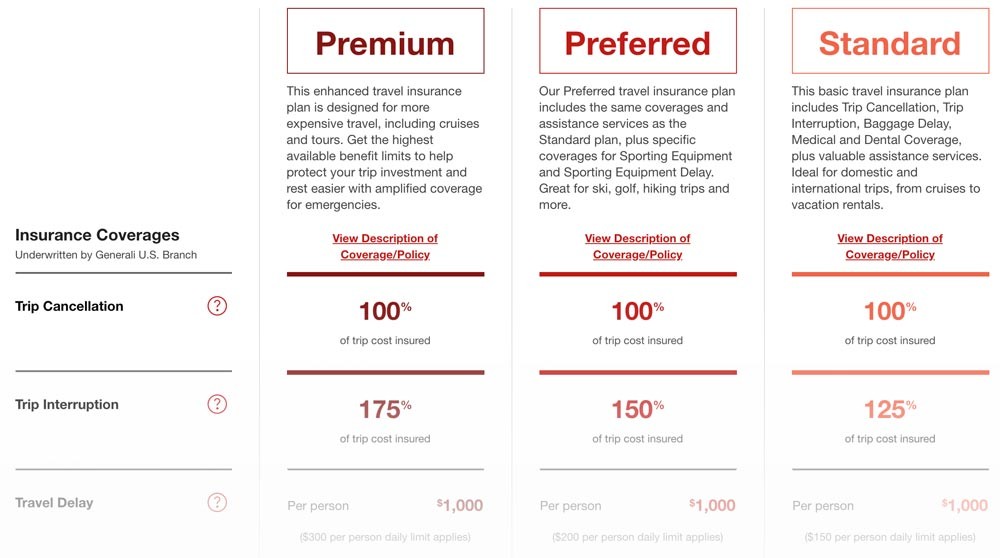

Types of Coverage for Family Travel Insurance

Review the different types of coverage provided by the insurance plan and assess their relevance to your travel needs. Determine whether you need comprehensive coverage that includes medical expenses, trip cancellation, baggage loss, and travel delays, or if you require specific coverage for certain risks.

Comparing Coverage Options from Different Insurance Providers

Obtain quotes and policy details from different insurance providers to compare the coverage options and costs. Consider the reputation and reliability of the insurance company, as well as the quality of customer service and claims handling. Ensure that you understand the terms and conditions of each policy and accurately compare the coverage provided.

Considerations for Pre-existing Conditions

Definition of Pre-existing Conditions

A pre-existing condition refers to any medical condition that exists before the effective date of the travel insurance policy. This can include chronic illnesses, ongoing medical treatments, or recent surgeries. It is important to understand how the insurance plan defines pre-existing conditions to determine if coverage is available.

Disclosure of Pre-existing Conditions

When applying for family travel insurance, it is essential to disclose all pre-existing conditions accurately and truthfully. Failure to disclose pre-existing conditions may result in denied claims or voided coverage. Make sure to provide complete and accurate medical information for all family members to ensure proper coverage.

Coverage Options for Pre-existing Conditions

Some insurance plans may offer coverage for pre-existing conditions, either as part of the standard coverage or as an optional add-on. However, coverage for pre-existing conditions may be subject to certain conditions, such as an additional premium or a waiting period. Consider your family’s medical history and any ongoing medical needs when evaluating the coverage options for pre-existing conditions.

Evaluating Medical Expenses Coverage

Understanding Medical Expenses Coverage

Medical expenses coverage in family travel insurance provides reimbursement for the costs incurred due to medical treatment, hospitalization, medication, and doctor visits during the trip. It is important to review the coverage limits and ensure they are sufficient for the countries you plan to visit, as healthcare costs can vary significantly worldwide.

Limits and Exclusions of Medical Expenses Coverage

Check the coverage limits to ensure they adequately cover potential medical expenses. Review any exclusions or limitations, such as specific medical treatments or procedures that may not be covered. Consider your family’s medical history and any potential medical needs when assessing the adequacy of the medical expenses coverage.

Types of Medical Expenses Covered

Different insurance plans may cover varying types of medical expenses. It is important to review the policy details to understand the specific medical treatments, tests, and procedures that are covered. Look for coverage that includes emergency medical treatment, hospitalization, prescription medication, and outpatient care.

Importance of Emergency Medical Evacuation Coverage

What is Emergency Medical Evacuation Coverage?

Emergency medical evacuation coverage provides financial assistance for the transportation of an injured or seriously ill family member to a medical facility capable of providing appropriate treatment. This coverage is particularly important when traveling to remote locations or countries with limited healthcare resources.

Benefits of Having Emergency Medical Evacuation Coverage

Emergency medical evacuation coverage ensures that you and your family can receive the necessary medical treatment in the event of a serious illness or injury, even if it requires transportation to another location. This coverage can be vital in situations where local medical facilities are not adequately equipped to provide the required care.

Determining the Coverage Limits for Emergency Medical Evacuation

Carefully review the coverage limits for emergency medical evacuation to ensure they are sufficient for your needs. Consider factors such as the distance to the nearest suitable medical facility, transportation costs, and any additional expenses, such as accommodations while waiting for medical transportation.

Ensuring Adequate Trip Cancellation Coverage

What is Trip Cancellation Coverage?

Trip cancellation coverage provides reimbursement for the non-refundable expenses incurred if you need to cancel your trip due to unforeseen circumstances. This can include illness, injury, death of a family member, or other events specified in the insurance policy.

Factors to Consider for Trip Cancellation Coverage

When evaluating trip cancellation coverage, consider the specific circumstances under which you can receive reimbursement. Review any limitations or exclusions to determine whether they align with your potential cancellation risks. Ensure that the coverage limits are sufficient to reimburse the non-refundable costs of your trip.

Limits and Exclusions for Trip Cancellation Coverage

Be aware of the coverage limits for trip cancellation and any exclusions that may limit your eligibility for reimbursement. Common exclusions may include cancellations due to pre-existing conditions or events that were already known at the time of purchasing the insurance. Familiarize yourself with the policy’s terms and conditions to understand what events are covered and any restrictions that may apply.

Protecting Baggage and Personal Belongings

Understanding Baggage and Personal Belongings Coverage

Baggage and personal belongings coverage provides reimbursement for lost, stolen, or damaged luggage and personal items during your trip. This coverage can help recoup the costs of replacing essential belongings and valuable items.

Coverage Limits and Exclusions

Review the coverage limits for baggage and personal belongings to ensure they are sufficient for your needs. It is essential to understand any exclusions or limitations, such as valuable items that may require additional coverage or specific items that may not be covered. Ensure that any valuable belongings are specifically listed in the policy.

Types of Items Covered

Different insurance plans may have varying coverage for specific types of items. Review the policy details to understand if the coverage includes electronics, jewelry, cash, or other valuable belongings. Consider the value of the items you plan to bring and their importance to your trip when assessing the adequacy of the coverage.

Dealing with Travel Delays and Missed Connections

Understanding Travel Delays and Missed Connections Coverage

Travel delays and missed connections coverage provides reimbursement for additional expenses incurred during delayed or missed flights or transportation. This can include costs for accommodation, meals, transportation, and other necessary expenses.

Coverage Limits and Exclusions

Review the coverage limits for travel delays and missed connections to ensure they adequately cover potential expenses. Understand any exclusions or limitations, such as specific circumstances under which reimbursement may not be provided. Review the policy terms and conditions to determine the eligibility requirements for reimbursement.

Reimbursements for Expenses Incurred Due to Travel Delays and Missed Connections

Ensure that the insurance plan provides reimbursement for expenses incurred due to travel delays and missed connections. Familiarize yourself with the documentation requirements for making a claim and the steps involved in the claims process. Keep all relevant receipts and documentation to support your claim for reimbursement.

Considering Political or Natural Disaster Coverage

What is Political or Natural Disaster Coverage?

Political or natural disaster coverage provides assistance and financial protection in the event of trip cancellations or disruptions due to civil unrest, terrorism, or natural disasters. This coverage ensures that you are protected if your travel plans are affected by unpredictable events.

Importance of Having This Coverage for Family Travel

Political or natural disasters can significantly impact travel plans, especially when traveling with family. Having coverage for such events can help provide financial assistance and support in making alternative arrangements. It can also offer peace of mind knowing that you have protection in case of unexpected disruptions.

Policy Specifics and Coverage Limitations

When considering political or natural disaster coverage, review the policy specifics to understand what events are covered and any limitations or exclusions that may apply. Ensure that the coverage limit is sufficient to cover potential costs incurred due to trip cancellations or disruptions. Familiarize yourself with the claims process and documentation requirements for making a claim related to political or natural disasters.

Ensuring Adventure Activities Coverage

Understanding Adventure Activities Coverage

Adventure activities coverage provides protection and assistance for families who engage in high-risk or adventurous activities during their travels. This coverage ensures that you are covered for any potential injuries or accidents that may occur while participating in these activities.

Types of Adventure Activities Covered

Different insurance plans may have varying coverage for adventure activities. Review the policy details to understand which activities are covered and if there are any exclusions or limitations. Ensure that the coverage includes the specific activities you and your family plan to engage in during your trip.

Limits and Exclusions for Adventure Activities Coverage

Review the coverage limits for adventure activities to ensure they are sufficient for potential injuries or accidents. Understand any exclusions or limitations that may apply, such as certain high-risk activities that are not covered. Ensure that you comply with any safety requirements or guidelines specified by the insurance plan.

Knowing the Exclusions and Limitations

Common Exclusions and Limitations in Family Travel Insurance

Exclusions and limitations are an important aspect of any insurance policy. Familiarize yourself with the common exclusions and limitations of family travel insurance to understand the risks and circumstances under which coverage may be voided or reduced. Common exclusions may include pre-existing conditions, self-inflicted injuries, or injuries resulting from participating in illegal activities.

Importance of Reading the Policy Documents Thoroughly

To ensure a clear understanding of the coverage and limitations, it is essential to read the policy documents thoroughly. Pay close attention to any fine print, exclusions, or limitations that may impact your coverage. If you have any questions or concerns, contact the insurance provider for clarification.

Factors to Consider When Evaluating Exclusions and Limitations

When evaluating the exclusions and limitations of the insurance policy, consider the specific risks associated with your travel plans. Assess the potential impact of excluded events or circumstances on your family’s safety and the financial implications of potential claims denial. Choose a policy that provides adequate coverage for the risks that are relevant to your trip.

Understanding the Claims Process

Steps Involved in Filing a Claim

In the event of a covered incident, it is important to understand the steps involved in filing a claim. Typically, this includes notifying the insurance provider as soon as possible, providing all necessary documentation, completing claim forms, and cooperating with any investigation that may be required.

Documentation Required for the Claims Process

The claims process typically requires documentation to support your claim. This may include receipts, medical reports, police reports, and any other relevant documentation. Ensure that you understand the specific documentation requirements and keep all receipts and documentation throughout your trip to facilitate the claims process.

Timelines for Claims Settlement

Bear in mind that the claims settlement process may take time, depending on various factors, such as the complexity of the claim and the insurance provider’s internal processes. Familiarize yourself with the expected timelines for claims settlement to manage your expectations accordingly.

Conclusion

Family travel insurance is a crucial aspect of any family vacation, providing financial protection and peace of mind during your travels. To choose the right plan, consider factors such as coverage, pre-existing conditions, medical expenses, emergency medical evacuation, trip cancellation, baggage and personal belongings, travel delays and missed connections, political or natural disaster coverage, adventure activities coverage, exclusions and limitations, claims process, and customer reviews and ratings. By carefully evaluating your coverage needs, comparing options from different insurance providers, and understanding the policy specifics, you can select a family travel insurance plan that offers comprehensive protection for your family’s travel experiences.