In this article, you will learn about the coverage and exclusions of family travel insurance. It is important to have a comprehensive understanding of what is included and what is not covered in your policy to ensure that you and your family are adequately protected during your trip. By understanding the specific details of your travel insurance policy, you can make informed decisions about your coverage and avoid any surprises or unexpected expenses along the way.

When it comes to family travel insurance, coverage typically includes medical expenses, trip cancellation or interruption, lost or delayed baggage, and emergency evacuation. These are essential aspects of coverage that you should look for when choosing a policy. However, it is also important to be aware of the exclusions that may apply. Common exclusions include pre-existing medical conditions, high-risk activities, and certain destinations that may not be covered. Familiarizing yourself with these exclusions will help you assess whether your policy meets your specific needs and if additional coverage is necessary.

Family Travel Insurance: What Does It Cover and Exclude

Family travel insurance is a type of insurance policy that provides coverage for families traveling together. It is designed to offer financial protection and peace of mind in case of unexpected events or emergencies during the trip. In this article, we will explore the definition of family travel insurance, its benefits, coverage options, exclusions, additional options, factors to consider while purchasing, top providers, tips for filing claims, steps to purchase, and the importance of having family travel insurance.

Definition of Family Travel Insurance

Family travel insurance, as the name suggests, is a specialized insurance policy that provides coverage for a family unit while traveling together. This type of insurance can be purchased for trips within a specific duration or as an annual policy that covers multiple trips throughout the year. It typically covers a wide range of risks and expenses that may arise during a trip, including medical emergencies, trip cancellations, lost baggage, and more.

Benefits of Family Travel Insurance

Family travel insurance offers numerous benefits that ensure the well-being and peace of mind of your loved ones during your trips. Some of the key benefits include:

-

Medical expenses coverage: Family travel insurance typically provides coverage for medical expenses incurred due to illness or injury during the trip. This can include hospitalization costs, doctor’s fees, medication expenses, and emergency medical evacuation if necessary.

-

Trip cancellation coverage: In case you need to cancel or cut short your trip due to unforeseen circumstances, family travel insurance can provide compensation for non-refundable expenses such as airline tickets, hotel bookings, and tour reservations.

-

Lost baggage coverage: If your luggage gets lost, stolen, or damaged during your trip, family travel insurance can offer compensation to replace your belongings, ensuring that you can continue your travels without any major disruptions.

These are just a few of the benefits provided by family travel insurance. The specific coverage and limits may vary depending on the insurance provider and the policy you choose.

Coverage in Family Travel Insurance

Family travel insurance typically offers coverage for various aspects of your trip. Here are the key coverage options you can expect:

Medical expenses coverage

One of the most crucial aspects of family travel insurance is coverage for medical expenses. This includes costs associated with illness, injury, and emergency medical evacuation. It is important to note that coverage for pre-existing medical conditions may be excluded, so it is vital to read the policy terms and conditions carefully.

Trip cancellation coverage

Family travel insurance can provide coverage for trip cancellation or interruption due to unforeseen events such as illness, death in the family, natural disasters, or other emergencies. This coverage ensures that you are compensated for non-refundable expenses and can help you reschedule or recover from the disruption.

Lost baggage coverage

If your luggage is lost, stolen, or damaged during your trip, family travel insurance can help cover the costs of replacing essential items. This coverage ensures that you can continue your trip without major inconveniences and avoid additional expenses for replacing your belongings.

These are the primary coverage options offered by family travel insurance. However, it is important to carefully review the policy details as coverage may vary depending on the insurance provider and the specific policy you choose.

Exclusions in Family Travel Insurance

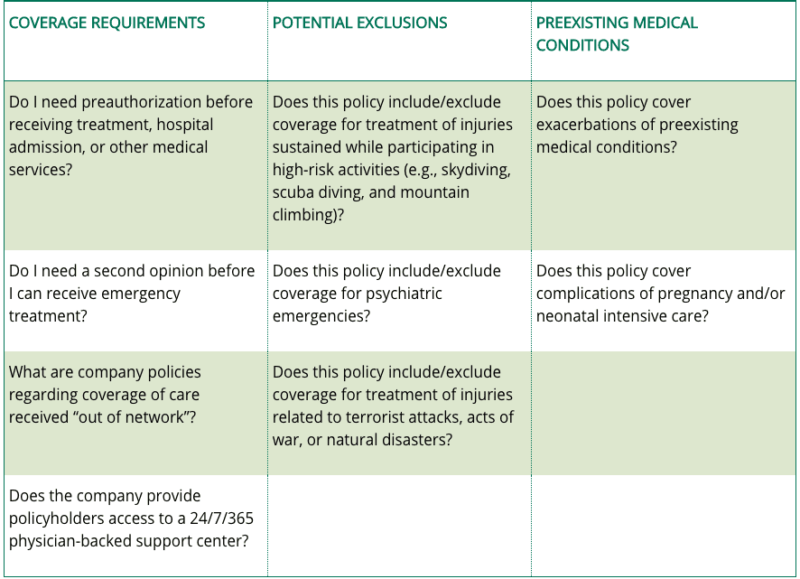

While family travel insurance provides extensive coverage, there are certain exclusions that you should be aware of. These are situations or events that are not covered by the insurance policy. Here are some common exclusions in family travel insurance:

Pre-existing medical conditions exclusion

Family travel insurance often excludes coverage for pre-existing medical conditions. This means that any medical expenses related to a pre-existing condition you or your family members have before the trip may not be covered. It is crucial to disclose any pre-existing conditions while purchasing the policy and speak with the insurance provider to understand the extent of coverage.

Extreme sports exclusion

Engaging in extreme or high-risk sports and activities may not be covered by family travel insurance. These activities typically include activities such as bungee jumping, paragliding, or other adventure sports. If you plan to participate in such activities during your trip, it is important to check if the insurance policy covers them or if you need to purchase additional coverage.

Acts of terrorism exclusion

Family travel insurance may exclude coverage for expenses related to acts of terrorism or political unrest in your travel destination. This means that if your trip is disrupted or you incur any expenses due to such events, the insurance may not provide compensation. It is crucial to understand the policy’s coverage regarding terrorism and unrest before purchasing.

These exclusions serve as a reminder to carefully read and understand the terms and conditions of the family travel insurance policy to ensure you have clear expectations of what is covered and excluded.

Additional Options in Family Travel Insurance

In addition to the standard coverage options, family travel insurance often offers additional options that can be tailored to your specific needs. These optional coverages can provide added protection and peace of mind during your trip. Here are a few common additional options available:

Emergency evacuation coverage

Emergency evacuation coverage provides financial protection in case you or a family member requires urgent medical evacuation due to a serious illness or injury. This coverage ensures that you are covered for transportation expenses to a suitable medical facility, which may be necessary in remote locations or during complex medical situations.

Rental car coverage

If you plan to rent a car during your trip, rental car coverage can be added to your family travel insurance policy. This coverage protects you from any financial liability in case of accidents, damage, or theft of the rental vehicle.

Pet coverage

If you are traveling with your furry friends, some insurance providers offer pet coverage as an additional option. This can cover expenses related to pet illnesses or injuries that occur during the trip, ensuring that your beloved pets are protected while you travel.

It is important to carefully evaluate these additional options and assess whether they are relevant to your specific needs. Adding these options can increase the cost of your family travel insurance policy, so it is essential to consider their value and importance for your trip.

Factors to Consider in Family Travel Insurance

When selecting family travel insurance, there are several factors to consider to ensure you choose the right policy for your needs. Here are some key factors to keep in mind:

Destination and duration

The destination and duration of your trip have a significant impact on the type and cost of family travel insurance. Some destinations may have higher healthcare costs or increased risk of theft, which can affect the coverage and premiums. Similarly, the duration of your trip may impact the coverage limits and exclusions. It is important to provide accurate information about your travel plans while purchasing insurance to ensure you have adequate coverage.

Age of family members

The age of your family members can also affect the coverage and premiums of family travel insurance. Some insurance providers may have age limits or specific terms for coverage of elderly family members or infants. It is important to check the policy’s age restrictions and understand any additional requirements or limitations for certain age groups.

Types of activities planned

If you have specific activities planned for your trip, such as adventure sports or extreme activities, it is important to check if they are covered by your family travel insurance policy. Some insurance policies exclude coverage for high-risk activities, so it may be necessary to purchase additional coverage or seek alternative insurance options specifically designed for adventure travelers.

Considering these factors will help you narrow down the options and select the family travel insurance policy that best aligns with your travel plans and requirements.

How to Choose the Right Family Travel Insurance

Choosing the right family travel insurance requires careful consideration of your specific needs and preferences. Here are some steps you can follow to make an informed decision:

Identify your family’s specific needs

Before you start comparing different insurance policies, it is essential to identify your family’s specific needs and priorities. Consider factors such as destination, duration, age of family members, planned activities, and budget. This will help you focus on policies that best meet your requirements.

Compare policies and coverage

Once you have a clear understanding of your family’s needs, start comparing different family travel insurance policies. Look for policies that offer comprehensive coverage for medical expenses, trip cancellations, lost baggage, and other potential risks. Pay attention to coverage limits, deductibles, and exclusions to ensure they align with your expectations.

Read customer reviews

Customer reviews can provide valuable insights into the quality of service and claims experience offered by different insurance providers. Reading reviews and testimonials from other families who have used the insurance can help you assess the reliability and customer satisfaction of each provider. Look for reviews specifically related to family travel insurance to ensure relevance.

Comparing policies, coverage, and customer reviews will help you make an informed decision while selecting the right family travel insurance for your needs.

Top Family Travel Insurance Providers

While there are several insurance providers offering family travel insurance, here are a few recognized names to consider:

XYZ Insurance Company

XYZ Insurance Company is known for its comprehensive coverage options and excellent customer service. They offer tailored family travel insurance policies that cater to the specific needs of families traveling together.

ABC Travel Insurance

ABC Travel Insurance is renowned for its comprehensive coverage and competitive premiums. They offer a range of policies that can be customized to fit your family’s travel plans.

123 Family Insurance

123 Family Insurance specializes in providing family travel insurance with generous coverage limits and affordable premiums. They pride themselves on their excellent claims process and customer support.

These are just a few examples of top family travel insurance providers. It is important to evaluate multiple options and choose the one that best suits your needs and budget.

Tips for Filing Family Travel Insurance Claims

In case you need to file a claim with your family travel insurance provider, here are some tips to facilitate the process:

Document all expenses and incidents

Keep a record of all expenses and incidents related to your claim. This includes medical bills, receipts for replacement items, police reports (in case of theft), and any other documentation relevant to your claim. This will help support your case and ensure a smooth claims process.

Contact the insurance provider immediately

As soon as you encounter an issue or need to file a claim, contact your insurance provider immediately. They will guide you through the claims process and provide you with the necessary forms and instructions. Prompt communication is vital to ensure your claim is handled efficiently.

Follow the claims process carefully

Carefully follow the claims process outlined by your insurance provider. This may involve submitting specific forms, providing supporting documentation, or seeking any required approvals. Any deviation from the process may lead to delays or complications in the claims settlement.

By documenting all expenses, promptly contacting your insurance provider, and following the claims process diligently, you can ensure a smooth and efficient claims experience.

Steps to Purchase Family Travel Insurance

Purchasing family travel insurance involves a few important steps to ensure you get the right coverage for your needs. Here is a step-by-step approach:

Research different insurance providers

Start by researching and exploring different insurance providers that offer family travel insurance. Consider their reputation, coverage options, pricing, and customer reviews. Shortlist a few providers that seem well-suited to your needs.

Request quotes and compare prices

Contact the shortlisted insurance providers and request quotes for family travel insurance policies. Compare the coverage, limits, exclusions, and premiums offered by each provider. Balance the coverage with the cost to find a policy that offers the best value for your money.

Purchase the chosen policy

Once you have made your decision, proceed to purchase the chosen policy. Pay careful attention to the terms and conditions, as well as any additional options or endorsements you may be adding to your policy. Make sure you understand the coverage and exclusions before finalizing the purchase.

Following these steps will help you navigate the process of purchasing family travel insurance, ensuring that you make an informed decision based on your specific needs and requirements.

Importance of Family Travel Insurance

Family travel insurance plays a crucial role in providing financial protection and peace of mind during your trips. Here are a few reasons why it is important to invest in family travel insurance:

Financial protection in case of emergencies

Emergencies can happen at any time, and they can be financially devastating. Family travel insurance provides coverage for medical expenses, trip cancellations, lost baggage, and other unforeseen events, helping you mitigate the financial impact of such emergencies.

Peace of mind for your family

Knowing that you have comprehensive coverage for your family’s health and well-being during your trip brings peace of mind. Family travel insurance allows you to focus on enjoying your trip without worrying about what might happen if something goes wrong.

Coverage for unexpected events

Traveling involves certain risks, such as flight cancellations, lost baggage, or medical emergencies. Family travel insurance offers coverage for these unexpected events, ensuring that you are not left stranded or burdened with unexpected expenses.

Investing in family travel insurance is a proactive measure that helps you safeguard your family’s well-being and financial stability during your trips.

Common Misconceptions About Family Travel Insurance

There are several misconceptions about family travel insurance that may influence people’s decision to purchase it. Let’s clarify some of the most common misconceptions:

It is only necessary for long trips

Family travel insurance is beneficial regardless of the duration of your trip. Even a short trip can involve unforeseen events or emergencies that family travel insurance can help mitigate. It is important to assess your family’s specific needs and the potential risks involved in your trip before deciding on the duration of coverage.

It is expensive

While the cost of family travel insurance varies depending on factors such as destination, duration, and coverage limits, it is often more affordable than people think. The cost of insurance is relatively small compared to the potential financial impact of unexpected events or emergencies during your trip.

It duplicates existing coverage

Some people assume that their existing health insurance or credit card coverage provides sufficient protection during their travels. However, most health insurance plans have limited coverage outside your home country, and credit card coverage may not offer comprehensive protection. Family travel insurance provides dedicated coverage specifically designed for travel-related risks, complementing any existing coverage you may have.

Understanding these misconceptions will help you make an informed decision when it comes to purchasing family travel insurance.

Factors That Can Affect Family Travel Insurance Premiums

The premiums for family travel insurance are influenced by various factors. Understanding these factors can help you anticipate the cost of coverage. Here are some key factors that can affect family travel insurance premiums:

Age of family members

The age of family members can impact the premiums for family travel insurance. Generally, older travelers may face higher premiums due to higher health risks. Some insurance providers may charge lower premiums for children or infants.

Health conditions

Pre-existing medical conditions can impact the premiums and coverage of family travel insurance. Insurance providers may exclude coverage for pre-existing conditions or charge higher premiums to account for the increased risk. It is important to disclose any pre-existing conditions accurately to ensure appropriate coverage.

Coverage limits

The coverage limits you choose can also affect the premiums for family travel insurance. Higher coverage limits typically result in higher premiums. It is important to assess your family’s needs and select coverage limits that provide adequate protection while fitting within your budget.

These factors, among others, are taken into consideration while calculating the premiums for family travel insurance. It is important to review them while purchasing the policy to understand the cost implications.

Conclusion

Family travel insurance is a valuable investment that provides essential coverage for your family’s well-being and peace of mind during trips. It offers a wide range of benefits, including coverage for medical expenses, trip cancellations, and lost baggage. However, it is crucial to carefully review the coverage and exclusions before purchasing a policy. Factors such as destination, duration, age of family members, and the activities planned should be considered while selecting the right policy. By comparing different insurance providers, reading customer reviews, and following the claims process diligently, you can ensure a smooth insurance experience. Family travel insurance provides financial protection, peace of mind, and coverage for unexpected events, making it a wise choice for families traveling together.