In this article, you will learn about the importance of having the necessary family travel insurance coverage. Traveling with your family can be an exciting and rewarding experience, but it is important to ensure that you have the right insurance coverage to protect yourself and your loved ones.

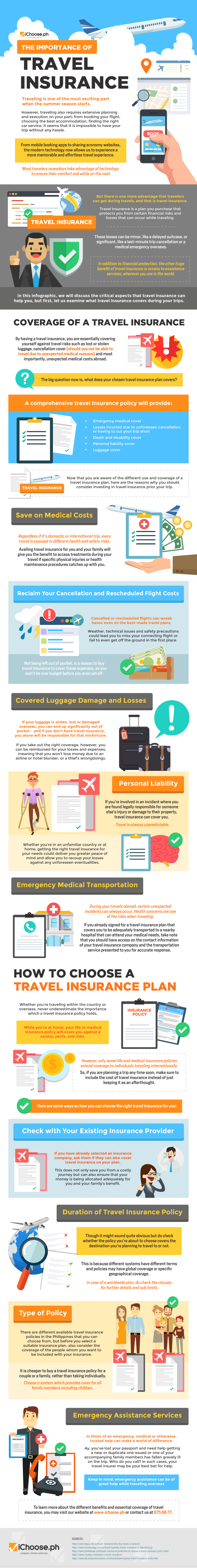

When you have the right travel insurance, it can provide financial protection in case of unexpected events such as medical emergencies, trip cancellations, lost baggage, or other unforeseen circumstances. It helps to ease your worries and ensure that you can enjoy your trip without constantly worrying about what might go wrong. By investing in the necessary family travel insurance coverage, you are taking a proactive step to safeguard your family’s well-being and financial security during your travels.

Introduction

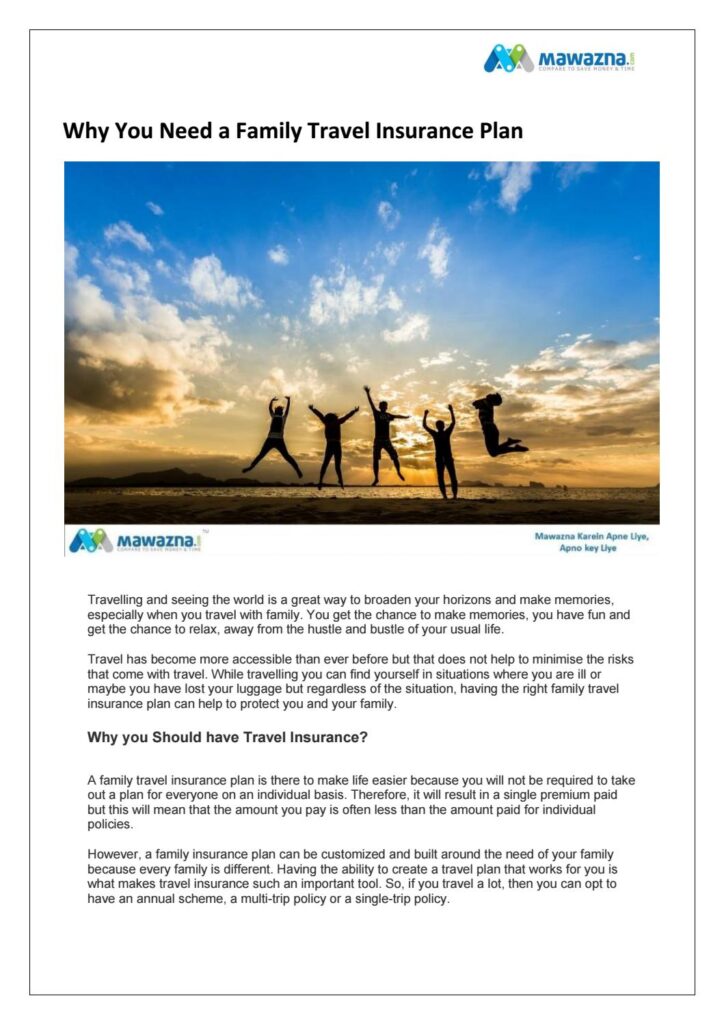

Traveling with your family can be an exciting and enriching experience, creating memories that will last a lifetime. However, it’s important to consider the potential risks and uncertainties that can arise during your trip. That’s where family travel insurance comes in. Understanding the significance of family travel insurance coverage is crucial to ensure that you and your loved ones are protected financially and medically in case of emergencies. In this article, we will explore the benefits of family travel insurance, how to choose the right coverage, factors to consider, policy coverage, exclusions and limitations, the claim process, the cost of family travel insurance, and specific considerations for children and seniors. By the end, you will have a thorough understanding of why necessary family travel insurance coverage should not be overlooked.

Benefits of Family Travel Insurance

Financial protection in case of emergencies

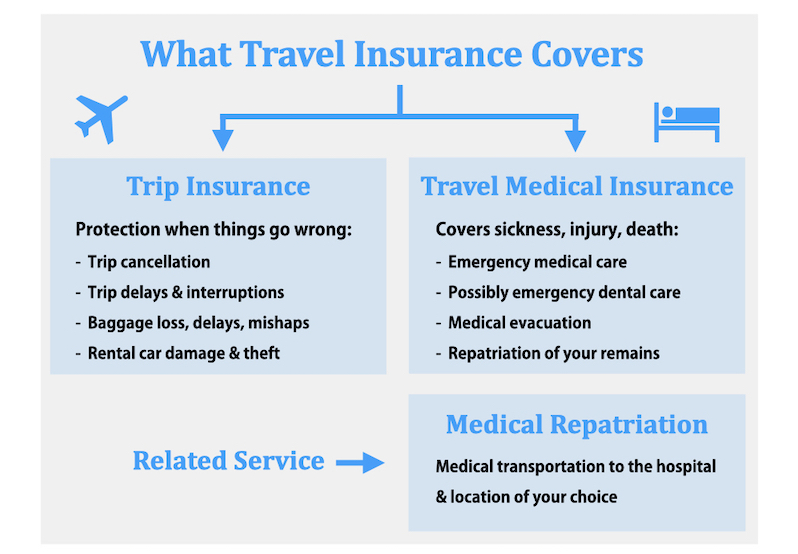

When you embark on a family vacation, the last thing you want to worry about is unexpected expenses. Family travel insurance provides financial protection in case of emergencies such as trip cancellations, delays, or interruptions. Imagine if you had to cancel your trip due to unforeseen circumstances, such as the sudden illness of a family member or a natural disaster in your destination. With the right insurance coverage, you can be reimbursed for non-refundable expenses and avoid bearing the full financial burden.

Coverage for medical expenses

One of the most important benefits of family travel insurance is the coverage it provides for medical expenses. Whether you or a family member falls ill or gets injured during your trip, medical costs can quickly add up. With family travel insurance, you can rest assured knowing that you have financial protection against unexpected medical emergencies. This coverage may include hospitalization, doctor visits, medication, and emergency medical evacuation, ensuring that you receive the necessary care without the worry of exorbitant expenses.

Assistance with travel-related issues

Travel-related issues can be a major inconvenience, especially when you have your family in tow. From lost passports to flight cancellations, these issues can disrupt your vacation and cause unnecessary stress. Family travel insurance often includes assistance services that can help you navigate these challenges. These services may include 24/7 emergency assistance, access to a helpline for travel advice, and assistance with replacing lost documents or arranging alternative travel arrangements. Having this support can make a significant difference when facing unexpected travel-related issues.

Protection for personal belongings

When traveling with your family, it’s not just your well-being that needs protection; your personal belongings need coverage too. Family travel insurance often includes protection against lost or stolen baggage, as well as coverage for valuable items such as electronics and jewelry. This can provide peace of mind knowing that if your luggage goes missing or your belongings are damaged, you will be compensated for your losses. It’s important to review the policy terms and conditions to understand the coverage limits and exclusions for personal belongings.

Choosing the Right Family Travel Insurance

Now that you understand the benefits of family travel insurance, it’s crucial to choose the right coverage for your specific needs. Here are some factors to consider when selecting the right family travel insurance:

Evaluating coverage options

Not all family travel insurance policies are the same, so it’s important to evaluate the coverage options available. Look for policies that provide comprehensive coverage for trip cancellations, medical emergencies, travel-related issues, and personal belongings. Check if the policy covers all the destinations you plan to visit and the activities you intend to engage in during your trip. Additionally, consider the coverage limits and deductibles to ensure they align with your needs.

Considering destination-specific coverage

Different destinations come with different risks and requirements. When choosing family travel insurance, consider the specific coverage needed for your destination. For example, if you are traveling to a country with high healthcare costs, you may want to ensure that your policy offers sufficient medical coverage. If you are planning adventure activities such as skiing or scuba diving, check if the policy covers these activities.

Comparing prices and policy features

Cost is an important consideration when choosing family travel insurance, but it shouldn’t be the sole determining factor. Compare the prices of different insurance providers, but also consider the policy features and benefits offered. Look for policies that strike a balance between affordability and comprehensive coverage. Reading customer reviews and seeking recommendations from friends and family can also help you make an informed decision.

Factors to Consider

When selecting family travel insurance, it’s important to consider certain factors that can affect your coverage and premium. Here are some factors to keep in mind:

Family size and composition

The size and composition of your family can influence your family travel insurance coverage and premium. Most policies define a family as two adults and any number of dependent children. If you have a larger family or if you are traveling with extended family members, you may need to look for policies that offer coverage for a larger group.

Health conditions and medical history

Your family’s health conditions and medical history can impact the coverage and premium of your travel insurance policy. Pre-existing medical conditions may require additional coverage or may be excluded altogether. It’s essential to disclose any relevant medical information accurately to ensure that you are adequately covered and to avoid any potential issues with claim settlements.

Travel activities and destinations

The activities you plan to engage in during your trip and the destinations you visit can affect the coverage and premium of your family travel insurance. Some policies exclude hazardous activities such as skydiving or rock climbing, so if you are planning activities of this nature, look for policies that provide coverage for adventure sports. Additionally, certain destinations may have higher risks or require specific coverage, such as countries with high healthcare costs or regions prone to natural disasters.

Understanding Policy Coverage

To fully understand the benefits of family travel insurance, it’s important to familiarize yourself with the policy coverage. Here are some key components of family travel insurance coverage:

Trip cancellation and interruption

Family travel insurance typically provides coverage for trip cancellations and interruptions. This may include reimbursement for non-refundable expenses such as airfare, accommodation, and prepaid activities if you have to cancel or cut short your trip due to unforeseen circumstances such as illness, injury, or a death in the family. Review the policy terms to understand the covered reasons for trip cancellations or interruptions.

Emergency medical assistance and evacuation

One of the most critical aspects of family travel insurance is coverage for medical emergencies. This can include reimbursement for medical expenses, emergency medical evacuation to a suitable medical facility, and repatriation of remains in the event of a tragedy. Be sure to check the coverage limits and the process for accessing emergency medical assistance to ensure that you are adequately protected.

Lost baggage and belongings

Family travel insurance often provides coverage for lost or stolen baggage and belongings. This can include reimbursement for the value of lost or stolen items, as well as coverage for essentials if your luggage is delayed. It’s important to review the policy terms and conditions to understand the maximum coverage limits and any exclusions or deductibles related to lost baggage and belongings.

Accidental death and dismemberment

In the unfortunate event of accidental death or dismemberment during your trip, family travel insurance can provide financial compensation to your beneficiaries. This coverage ensures that your family is protected in case of a tragic incident. Review the policy terms to understand the coverage limits and exclusions related to accidental death and dismemberment.

Exclusions and Limitations

While family travel insurance provides essential coverage, it’s essential to be aware of the exclusions and limitations of the policy. Here are some common exclusions and limitations to consider:

Pre-existing medical conditions

Most family travel insurance policies exclude coverage for pre-existing medical conditions. This means that if you or a family member has a pre-existing condition, such as diabetes or heart disease, any complications or medical treatment related to that condition may be excluded from coverage. It’s important to disclose all relevant medical information accurately when purchasing your policy to avoid any issues with claim settlements.

Adventure sports and hazardous activities

If you plan to engage in adventure sports or hazardous activities during your trip, be aware that not all family travel insurance policies automatically cover these activities. Skydiving, bungee jumping, and scuba diving are some examples of activities that may be excluded from coverage. It’s important to check the policy terms and conditions to see if coverage for adventure sports can be added as an additional option.

High-value items and electronics

Family travel insurance policies typically have coverage limits for expensive or high-value items such as electronics, jewelry, or designer clothing. If you plan to travel with valuable items, review the policy’s coverage limits to ensure that they align with the value of your belongings. It’s also a good idea to keep receipts or proof of purchase for these items, as they may be required when filing a claim.

Claim Process and Documentation

In the unfortunate event that you need to make a claim on your family travel insurance, it’s important to understand the claim process and gather the necessary documentation. Here are the steps involved:

Contacting the insurance provider

As soon as you encounter an issue that may qualify for a claim, contact your insurance provider’s claims department. They will guide you through the process and provide any necessary instructions or forms. Be sure to provide clear and accurate information about the incident and any supporting documentation you may have.

Providing necessary documents

When filing a claim, you will typically need to provide supporting documentation. This may include medical reports, police reports for theft or loss of belongings, receipts or proof of purchase for damaged items, and any other relevant documentation. Make copies of all documents before submitting them to the insurance provider and keep the originals for your records.

Filing the claim

Once you have gathered all the necessary documentation, complete the required claim forms provided by your insurance provider. Be thorough and accurate when filling out the forms to avoid any delays or issues with claim settlements. Submit the claim forms, along with the supporting documents, to the insurance provider according to their instructions.

Cost of Family Travel Insurance

The cost of family travel insurance can vary depending on several factors. Here are some key considerations that can influence the cost:

Premiums based on coverage and duration

The cost of family travel insurance is typically determined by the coverage options and the duration of your trip. The more comprehensive the coverage and the longer the trip, the higher the premium is likely to be. Consider the specific coverage you need for your family and the duration of your trip to ensure that you are balancing cost and coverage effectively.

Additional factors influencing cost

In addition to coverage and duration, there are other factors that can influence the cost of family travel insurance. These factors may include the destination of your trip, the ages of the insured individuals, and any pre-existing medical conditions. It’s important to disclose accurate information and answer all relevant questions honestly when requesting a quote to ensure that you receive an accurate premium estimate.

Travel Insurance for Children

Children are often the most vulnerable members of the family when it comes to travel risks. Having appropriate travel insurance for children is crucial to ensure their well-being. Here are some important considerations for insuring children during travel:

Coverage options for infants and minors

When selecting family travel insurance, ensure that the policy offers suitable coverage options for infants and minors. This may include coverage for medical emergencies, as well as protection for their personal belongings. Some policies may have age restrictions or offer different coverage options for children, so review the policy terms and conditions carefully.

Importance of protecting children during travel

Children can be more prone to accidents, illnesses, and other unexpected situations during travel. Protecting their health and well-being is of utmost importance. Travel insurance can provide financial protection and access to necessary medical treatment if a child falls ill or gets injured during the trip. It’s crucial to ensure that your family travel insurance includes provision for children’s medical needs.

Travel Insurance for Seniors

For seniors, there may be additional considerations when it comes to travel insurance. Here are some factors to keep in mind when selecting travel insurance for seniors:

Considering age-related health concerns

As we age, health concerns become more common. It’s important to consider age-related health conditions and ensure that they are adequately covered by the travel insurance policy. This may involve disclosing pre-existing conditions, purchasing additional coverage for specific health needs, or seeking specialized travel insurance for seniors.

Specialized coverage for elderly travelers

Some insurance providers offer specialized coverage options for elderly travelers. These policies may take into account the specific needs and risks associated with senior travel. Specialized coverage for seniors may include higher medical coverage limits, coverage for pre-existing conditions, and additional benefits specific to the needs of older travelers. It’s important to research and compare different insurance providers to find the best fit for your specific needs.

Importance of Disclosure

When purchasing family travel insurance, it’s crucial to provide accurate and complete information. The information you provide during the application process can impact the coverage and validity of your policy. Here’s why accurate disclosure is important:

Accurate and complete information

Insurance providers rely on the information you provide to assess the risks associated with insuring your family. It’s important to provide accurate and complete information about your family members, their ages, any pre-existing medical conditions, and any planned activities during your trip. Failure to disclose relevant information can lead to claim denials or policy cancellations.

Effect on claim settlement

If you need to make a claim on your family travel insurance, the accuracy and completeness of the information you provided during the application process can affect the claim settlement. Insurance providers may investigate the circumstances of a claim and can deny a claim if they discover that inaccurate or incomplete information was initially provided. It’s crucial to be honest and forthcoming during the application process to ensure that your claims are settled fairly and efficiently.

Comparing Travel Insurance Providers

Choosing the right travel insurance provider is just as important as selecting the right coverage. Here are some factors to consider when comparing travel insurance providers:

Researching reputation and customer reviews

Before purchasing family travel insurance, research the reputation of the insurance provider. Look for reviews from previous customers to get a sense of their experiences and level of satisfaction. You can also seek recommendations from friends, family, or travel professionals who have had positive experiences with specific insurance providers.

Examining financial stability

When selecting an insurance provider, it’s important to consider their financial stability. You want to choose a provider that has the means to fulfill their financial obligations in the event of a claim. Check if the insurance provider is backed by a reputable financial institution and inquire about their financial strength ratings if available.

Checking customer support and claims process

The customer support provided by the insurance company can make a significant difference during the claim process. Look for insurance providers that offer 24/7 support and have a dedicated claims department. Consider the efficiency and transparency of their claims process to ensure that you will have a smooth experience in case you need to make a claim.

Tips for Utilizing Family Travel Insurance

To fully maximize the benefits of family travel insurance, here are some tips to keep in mind:

Understanding policy exclusions and limitations

Before your trip, take the time to thoroughly review your family travel insurance policy. Understand the exclusions and limitations to ensure that you are aware of any specific circumstances or activities that may not be covered. This will help you take preventive measures, manage risks, and avoid any surprise limitations when making a claim.

Keeping copies of important documents

When traveling with your family, it’s important to keep copies of important documents such as passport information, travel itineraries, travel insurance policy documents, and emergency contact information. Store these copies in a secure location separate from the originals. In case of loss or theft, having copies of these documents can facilitate the claims process and help you navigate travel-related issues more smoothly.

Emergency contact information

Before your trip, make note of emergency contact information provided by your travel insurance provider. This may include helplines, local representatives, and specific instructions for accessing emergency assistance. Having this information readily available can save time and provide peace of mind during stressful situations.

Conclusion

Family travel can be an incredible experience, but it’s important to prioritize the safety and well-being of your loved ones. Necessary family travel insurance coverage provides much-needed financial and medical protection in case of emergencies. By understanding the benefits of family travel insurance, choosing the right coverage, considering key factors, and being aware of policy coverage, exclusions, and limitations, you can ensure that your family is well-protected during your travels. With proper disclosure, comparing insurance providers, and utilizing tips for utilizing family travel insurance, you will have the peace of mind to enjoy an unforgettable trip knowing that you have taken the necessary steps to protect your family. Safe travels!