In this article, you will learn about the different options available for family travel insurance policy amounts. When planning a trip with your family, it’s important to make sure you have the right amount of coverage. By understanding the various options and their corresponding benefits, you can make an informed decision that provides the necessary protection for your loved ones while traveling.

When it comes to choosing a family travel insurance policy, there are typically different amount options available. The amount you select will determine the level of coverage you and your family will receive in case of any unforeseen circumstances during your trip. Some policies offer a fixed amount of coverage for all family members, while others may allow you to customize the coverage for each individual. It’s crucial to carefully consider your family’s needs and factors such as the duration of your trip, the activities you’ll be engaging in, and the potential risks involved. By understanding the policy amount options, you can ensure that you have the right level of coverage to protect your family’s well-being while traveling.

What is Family Travel Insurance?

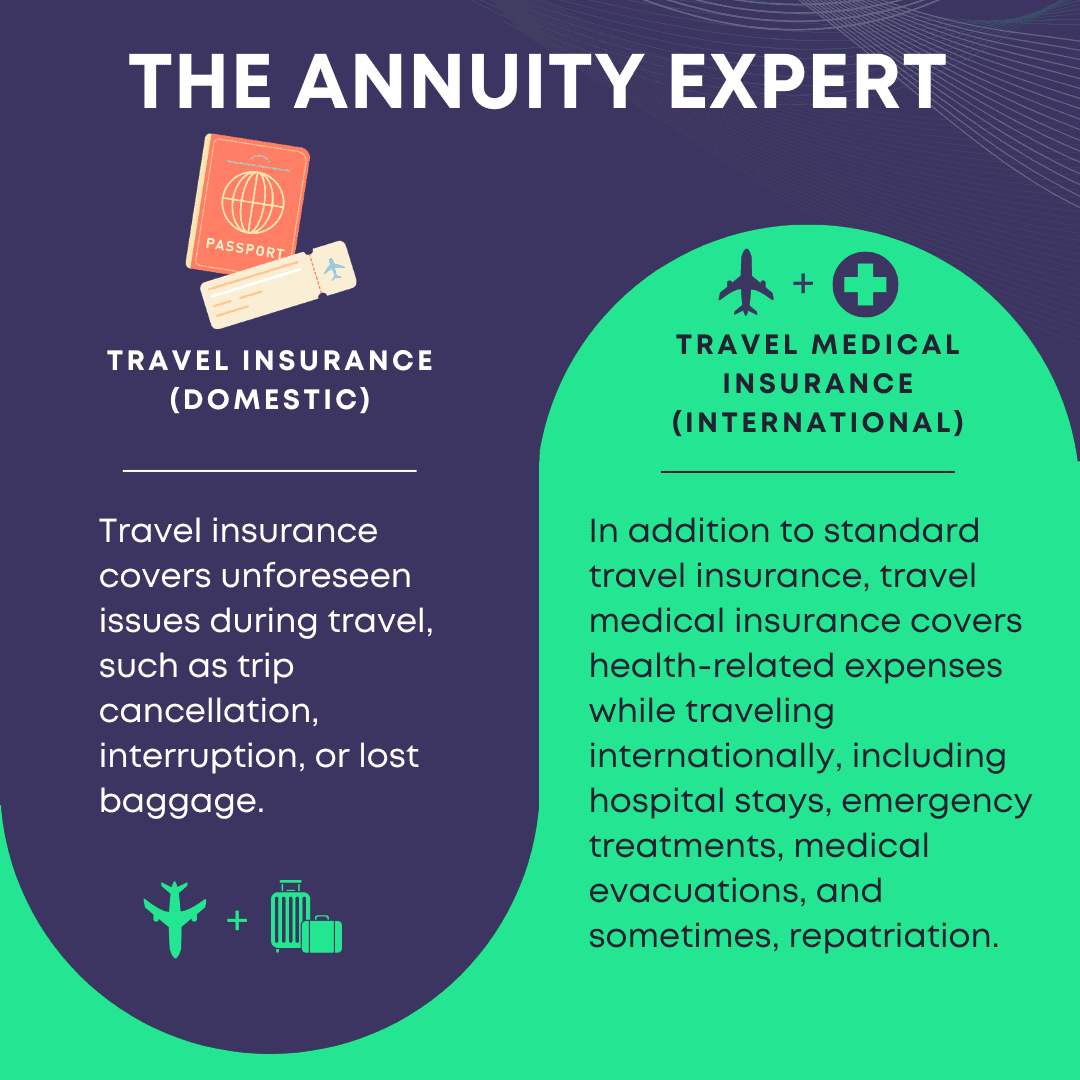

Family travel insurance is a type of insurance coverage designed to protect your entire family during vacations and travels. It provides financial protection against unexpected events and offers peace of mind, ensuring that you can enjoy your trips without worrying about potential risks and expenses.

Coverage for the whole family

One of the primary benefits of family travel insurance is that it covers all members of your family, including children and elderly relatives. This means that if anyone in your family falls ill or gets injured during the trip, they will be eligible for medical coverage and assistance.

Protection against travel-related risks

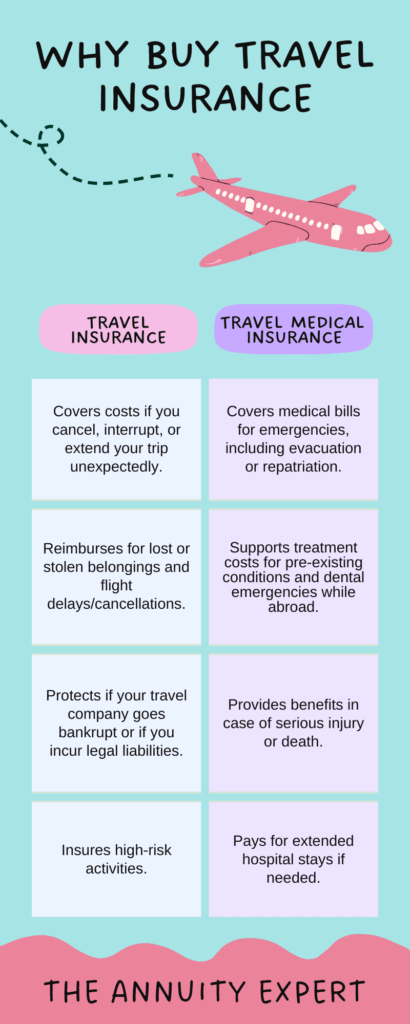

Traveling exposes you to various risks, such as medical emergencies, trip cancellations, lost baggage, and more. Family travel insurance provides coverage for these risks, ensuring that you are financially protected in case something goes wrong during your trip.

Peace of mind during vacations

One of the most significant advantages of having family travel insurance is the peace of mind it brings. Knowing that you have comprehensive coverage for your entire family allows you to enjoy your vacations without constantly worrying about unexpected expenses or emergencies.

Importance of Policy Amount Options

When it comes to family travel insurance, having policy amount options is essential. It allows you to customize your coverage based on your family’s specific needs and preferences. Here are some reasons why policy amount options are important:

Tailoring coverage to suit your needs

Every family is unique and has different needs and travel habits. Having policy amount options enables you to tailor your coverage to suit your specific requirements. You can choose a policy that provides the right level of protection for your family without overpaying for unnecessary coverage.

Flexibility in choosing policy limits

Policy amount options give you the flexibility to choose the appropriate coverage limits for different aspects of your travel insurance. You can select the ideal policy limits for medical expenses, trip cancellations, and baggage loss, among other coverage areas. This ensures that you have adequate protection without being underinsured or overinsured.

Financial protection for unexpected events

Travel plans can be disrupted by unforeseen events, such as a sudden illness, accident, or natural disaster. Having various policy amount options allows you to choose a level of coverage that provides sufficient financial protection against these unexpected events. This ensures that you are not burdened with significant expenses due to unforeseen circumstances.

Different Policy Amount Options

Family travel insurance policies typically offer different policy amount options to cater to various needs. Here are three common policy amount options:

Basic policy amount

The basic policy amount is the minimum level of coverage available. It provides essential protection for medical expenses, trip cancellations, and other covered risks. This is an excellent option if you are looking for affordable coverage without extensive benefits.

Standard policy amount

The standard policy amount offers a more comprehensive level of coverage compared to the basic policy amount. It includes enhanced benefits and higher coverage limits for medical expenses, trip cancellations, and other travel-related risks. This option is suitable for families who want more comprehensive protection during their travels.

Enhanced policy amount

The enhanced policy amount is the highest level of coverage available. It provides extensive benefits and higher coverage limits for all aspects of travel insurance, including medical expenses, trip cancellations, baggage loss, and more. This option is ideal for families who want maximum protection and peace of mind during their vacations.

Factors to Consider When Choosing a Policy Amount

When deciding on the policy amount for your family travel insurance, several factors should be taken into consideration. Here are some essential factors to consider:

Number of family members

The number of family members included in the travel insurance policy will affect the policy amount. If you have a large family, you may need higher coverage limits to ensure that everyone is adequately protected.

Duration and destination of travel

The duration and destination of your travel also play a crucial role in determining the appropriate policy amount. Longer trips and travel to high-risk destinations may require higher coverage limits to account for potential risks and expenses.

Risk assessment and personal circumstances

Assessing your family’s specific risks and vulnerabilities is essential when choosing the policy amount. Consider factors such as the age and health conditions of family members, as well as any pre-existing medical conditions that may require additional coverage. It’s important to ensure that your policy amount adequately covers these specific risks.

Understanding Coverage Limits

Coverage limits refer to the maximum amount the insurance company will pay for specific benefits. When choosing a policy amount, it’s essential to understand the coverage limits associated with each aspect of the travel insurance. Here are some common coverage limits you should be aware of:

Medical expenses coverage

Medical expenses coverage typically includes expenses related to emergency medical treatments, hospital stays, doctor visits, and prescription drugs. The coverage limit might range from a few thousand dollars to tens of thousands of dollars, depending on the policy amount chosen.

Trip cancellation or interruption coverage

Trip cancellation or interruption coverage reimburses you for non-refundable expenses if your trip is canceled or cut short due to covered reasons, such as illness, injury, or a natural disaster. The coverage limit is usually stated as a percentage of the total trip cost, such as 100%, 150%, or 200%.

Lost or delayed baggage coverage

Lost or delayed baggage coverage provides reimbursement for essential items if your baggage is lost, stolen, or delayed during your trip. The coverage limit typically ranges from a few hundred dollars to a few thousand dollars, depending on the policy amount chosen.

Additional Coverage Options

In addition to the basic coverage options, family travel insurance often offers additional coverage options that can be added to your policy. These additional coverage options provide enhanced protection and peace of mind during your travels. Here are some common additional coverage options:

Emergency medical evacuation

Emergency medical evacuation coverage provides coverage for the cost of medically necessary transportation to the nearest adequate medical facility if you or a family member becomes seriously ill or injured during your trip. This coverage is especially important when traveling to remote or high-risk destinations.

Accidental death and dismemberment

Accidental death and dismemberment coverage provides a lump sum benefit in the event of death or severe injury caused by an accident during your trip. This coverage can provide financial support to your family in case of a tragic incident.

Rental car damage protection

Rental car damage protection covers any damages to a rental car during your trip. It can save you from having to pay out-of-pocket for costly repairs or replacement of a rental vehicle if an accident occurs.

Exclusions and Limitations

It’s essential to be aware of the exclusions and limitations of your family travel insurance policy. Exclusions are specific perils or situations that are not covered by the insurance policy, while limitations are restrictions on the coverage provided. Here are some common exclusions and limitations to be aware of:

Pre-existing medical conditions

Most travel insurance policies exclude coverage for pre-existing medical conditions. If you or any family member has a pre-existing condition, it’s important to understand the limitations and exclusions related to your policy. Some policies offer optional coverage for pre-existing conditions, but they may have additional requirements and limitations.

High-risk activities

Certain high-risk activities, such as extreme sports or hazardous recreational activities, may be excluded from coverage or require additional coverage endorsements. If your family plans to engage in any high-risk activities during your travels, make sure to check if they are covered by your policy or if you need to add extra coverage.

War or acts of terrorism

Most travel insurance policies exclude coverage for losses or damages caused by war, acts of terrorism, or civil unrest. If you are traveling to a high-risk destination with a history of political instability or terrorist activities, it’s essential to understand the limitations and exclusions related to these risks.

Comparison of Policy Amount Options

When choosing a policy amount for your family travel insurance, it’s important to compare the different options available. Here are some factors to consider when comparing policy amount options:

Coverage inclusions and exclusions

Carefully review the coverage inclusions and exclusions of each policy amount option. Ensure that the coverage aligns with your family’s specific needs and preferences. Look for any additional benefits or limitations that may be important to you.

Premium cost variations

The premium cost for family travel insurance can vary based on the policy amount chosen. Consider the premium cost associated with each policy amount option and evaluate it against your budget. However, it’s important to note that cheapest may not always be the best choice. You should prioritize coverage and benefits over price alone.

Claim settlement process

Research the claim settlement process for each policy amount option. Check customer reviews and ratings to understand the effectiveness and efficiency of the insurance company’s claim settlement procedures. A smooth and hassle-free claims process can make a significant difference during stressful times.

Understanding Policy Terms and Conditions

Before finalizing your family travel insurance policy, it’s crucial to understand the policy’s terms and conditions. Here are some key aspects to consider:

Policy duration and renewability

Understand the duration of the policy and if it covers multiple trips or is valid only for a single trip. Additionally, check if the policy is renewable and if it can be extended in case your travel plans change.

Cancellation and refund policies

Make sure to read and understand the policy’s cancellation and refund policies. Familiarize yourself with any cancellation fees, timeframes, or restrictions that may apply. This information will be crucial if your travel plans change or if you need to cancel your policy.

Policyholder obligations

Review the policyholder obligations section of the policy document. This section will outline your responsibilities as the policyholder, including providing accurate information, reporting claims promptly, and complying with any specific requirements or procedures.

Importance of Reading the Fine Print

Reading the fine print of your family travel insurance policy is crucial to avoid any surprises or misunderstandings. Here are some reasons why reading the fine print is important:

Hidden clauses and exceptions

The fine print often contains important details about exclusions, limitations, and specific conditions that may affect your coverage. By reading the fine print, you can identify any hidden clauses or exceptions that may have an impact on your insurance coverage.

Understanding policy terminology

Insurance policies often contain industry-specific terminology that may be unfamiliar to the average person. Reading the fine print allows you to familiarize yourself with these terms and understand the full extent of your coverage.

Full disclosure of personal information

The fine print may include details about your duty to provide full and accurate personal information when applying for the policy. It’s important to read and understand these disclosure requirements to ensure that your policy remains valid in case of a claim.

Benefits of Family Travel Insurance

Family travel insurance offers several benefits that make it an essential investment for your vacations. Here are some key benefits of having family travel insurance:

Financial protection against unforeseen circumstances

Family travel insurance provides financial protection against unexpected events that can disrupt your travel plans or result in significant expenses. Whether it’s a medical emergency, trip cancellation, or lost baggage, having insurance coverage ensures that you are not burdened with substantial out-of-pocket costs.

Assistance and support during emergencies

In case of a medical emergency or other travel-related emergencies, family travel insurance offers assistance and support. Insurance companies often have 24/7 emergency helplines that can provide guidance, arrange medical services, or help with other necessary arrangements during stressful situations.

Coverage for various travel-related risks

Family travel insurance policies cover a wide range of travel-related risks, such as medical emergencies, trip cancellations, lost baggage, flight delays, and more. Having comprehensive coverage ensures that you are protected against these risks, giving you peace of mind during your trips.

Choosing the Right Family Travel Insurance Policy Amount

Choosing the right family travel insurance policy amount requires careful consideration of your family’s needs and travel habits. Here are some steps to help you make the right choice:

Evaluate your family’s needs and travel habits

Assess your family’s specific needs, preferences, and travel habits. Consider factors such as the number of family members, their ages, any pre-existing medical conditions, and the types of activities you plan to engage in during your travels.

Consider the potential risks and vulnerabilities

Think about the potential risks and vulnerabilities associated with your travel destinations and activities. This can include risks such as healthcare quality and accessibility, natural disasters, political instability, or other potential disruptions.

Seek advice from insurance professionals

If you are unsure about which policy amount to choose, seek advice from insurance professionals. They can help you understand the available options and recommend a policy amount that best suits your family’s needs and budget.

Conclusion

Family travel insurance policy amount options provide flexibility and tailored coverage for your specific needs. Understanding the different policy amounts and coverage limits ensures you choose the right insurance for your family’s travel protection. By carefully reviewing the terms, conditions, and exclusions, you can make an informed decision and enjoy peace of mind during your vacations. Remember to read the fine print, compare policy options, and seek advice when necessary. With the right family travel insurance in place, you can travel with confidence, knowing that you and your loved ones are protected from unforeseen circumstances.