In this article, you will learn a guide to filing claims with family travel insurance. Whether you are planning a vacation with your loved ones or taking a trip with your extended family, having travel insurance can provide peace of mind. This guide will walk you through the process of filing claims and ensure that you have a smooth and successful experience.

Firstly, it is important to understand the coverage provided by your family travel insurance policy. Familiarize yourself with the policy’s terms and conditions, including what is covered and what is not. This will help you determine if the situation you are facing is eligible for a claim. Next, gather all the necessary documentation to support your claim, such as medical reports, police reports, or proof of trip cancellation. Submitting complete and accurate documentation will increase your chances of a successful claim. Lastly, contact your insurance provider as soon as possible to notify them of your intent to file a claim. They will guide you through the claims process and provide you with the necessary forms and instructions. By following these steps, you can navigate the claims process efficiently and ensure that you receive the coverage you are entitled to.

What is Family Travel Insurance?

Family travel insurance provides coverage for families when they are traveling, ensuring that they have financial protection in case something unexpected happens during their trip. It is designed to cover a variety of scenarios such as medical emergencies, trip cancellations or interruptions, lost or delayed baggage, and more. By having family travel insurance, you can have peace of mind knowing that you and your loved ones are protected financially during your travels.

Coverage for

Family travel insurance typically provides coverage for a range of situations, including:

- Medical expenses: This includes coverage for emergency medical treatment, hospital stays, and medications.

- Trip cancellation or interruption: If you are forced to cancel or cut short your trip due to unforeseen circumstances, such as an illness or injury, family travel insurance can provide compensation for the non-refundable expenses.

- Delayed or lost baggage: If your baggage is delayed, lost, or stolen during your trip, family travel insurance can offer reimbursement for the essential items you need to replace.

- Emergency assistance and evacuation: In the event of a medical emergency or other unforeseen circumstances, family travel insurance can cover the costs of emergency medical transportation and evacuation.

- Personal liability: Family travel insurance can also provide coverage in case you are held liable for any damage or injury caused to someone else or their property.

Benefits of

There are several benefits to having family travel insurance, including:

- Financial protection: Family travel insurance provides financial protection in case of unexpected events during your trip, ensuring that you are not burdened with high medical expenses or non-refundable trip costs.

- Peace of mind: Knowing that you are covered by family travel insurance can give you peace of mind during your travels, allowing you to fully enjoy your vacation without worrying about potential financial risks.

- Assistance and support: Family travel insurance often comes with emergency assistance services, such as 24/7 helplines, that can provide guidance and support in case of emergencies or unexpected situations.

- Convenient claims process: With family travel insurance, the claims process is usually straightforward and easy, making it easier for you to file a claim and receive the necessary reimbursement.

Eligibility for

Family travel insurance is typically available for individuals below a certain age, usually up to 70 years old. The policy usually covers the policyholder, their spouse or partner, and their dependent children. Some policies may also include coverage for additional family members, such as parents or grandparents. It is important to carefully review the policy terms and conditions to ensure that your family members are eligible for coverage.

Choosing the Right Family Travel Insurance

When choosing the right family travel insurance, there are several factors to consider to ensure that you get the most suitable coverage for your needs.

Factors to consider

Here are some factors to consider when choosing family travel insurance:

- Coverage limits: Check the coverage limits for medical expenses, trip cancellation, baggage loss, and emergency assistance to ensure that they meet your needs.

- Pre-existing conditions: If you or your family members have pre-existing medical conditions, check if the policy covers them or if you need to purchase additional coverage.

- Destination coverage: Make sure that the policy provides coverage for the specific countries or regions you plan to visit.

- Deductibles and excess: Take note of the deductibles and excess amounts that you would need to pay in case of a claim and ensure that they are reasonable.

- Policy exclusions: Read the policy exclusions carefully to understand what is not covered under the policy.

Policy options

There are several policy options available when it comes to family travel insurance, including:

- Single trip insurance: This provides coverage for a specific trip and is ideal for families who do not travel frequently.

- Annual multi-trip insurance: If your family travels multiple times within a year, an annual multi-trip insurance policy may be a more cost-effective option.

- Group insurance: Some insurance providers offer group policies specifically designed for families traveling together, providing coverage for all members under a single policy.

Comparing plans

To ensure that you are getting the most suitable family travel insurance, it is important to compare different plans from various insurance providers. Look at factors such as coverage limits, policy exclusions, premiums, and customer reviews. Consider seeking the assistance of a licensed insurance agent who can help you understand the different policies and recommend the most suitable one for your family.

Understanding the Claims Process

In the unfortunate event that you need to file a claim with your family travel insurance, it is important to understand the claims process to ensure a smooth and successful outcome.

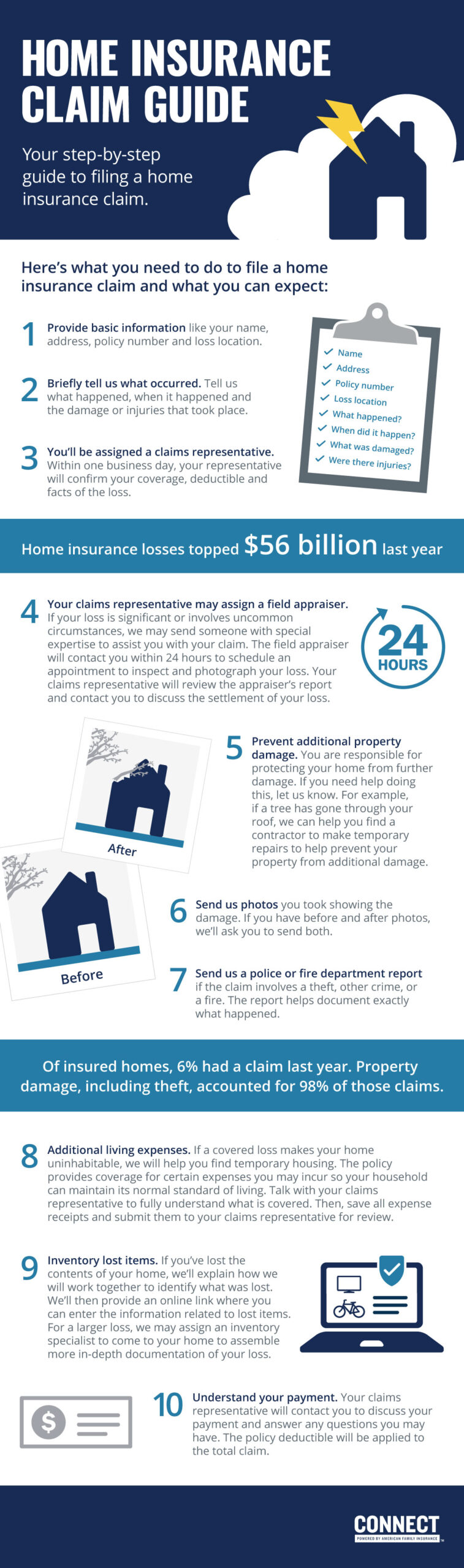

Submitting a claim

To submit a claim, you will need to:

- Contact your insurance provider as soon as possible to inform them about the incident and initiate the claims process.

- Complete the necessary claim forms provided by the insurance company, providing accurate and detailed information about the incident and the expenses incurred.

- Submit any supporting documentation required, such as medical reports, receipts, or proof of trip costs. Ensure that you keep copies of all documents for your records.

Required documentation

The required documentation for a family travel insurance claim may include:

- Medical reports: In case of medical emergencies, provide medical reports, diagnosis, and treatment details from the healthcare provider.

- Receipts and proof of payment: Keep all receipts and proof of payment for medical expenses, replacement items, or trip-related expenses.

- Police reports: If your belongings are lost or stolen, file a police report and provide a copy as supporting documentation.

- Proof of trip costs: In case of trip cancellation or interruption, provide proof of the non-refundable expenses, such as flight bookings, accommodation, or tour fees.

Claim investigation

Once you have submitted your claim, the insurance company will review the information and documentation provided. They may conduct an investigation to verify the details of the claim. This may include contacting healthcare providers, requesting additional documentation, or conducting interviews with the policyholder or witnesses. It is important to cooperate fully with the claims investigation to ensure a timely resolution.

Common Types of Covered Claims

Family travel insurance typically covers a range of claims. Here are some common types of covered claims:

Health emergencies

If you or a family member experiences a medical emergency during your trip, family travel insurance can provide coverage for medical expenses, hospital stays, and emergency medical transportation.

Trip cancellation or interruption

In case of unforeseen circumstances that force you to cancel or cut short your trip, such as illness, injury, or a natural disaster, family travel insurance can provide compensation for the non-refundable expenses, including flights, accommodation, and tour fees.

Delayed or lost baggage

If your baggage is delayed, lost, or stolen during your trip, family travel insurance can provide reimbursement for the essential items you need to replace, such as clothing, toiletries, and medication.

Documenting Medical Expenses

If you need to file a claim for medical expenses with your family travel insurance, it is important to document the expenses properly to ensure a successful claim.

Medical bills

Keep all medical bills and invoices related to the treatment received. Ensure that the bills include detailed information such as the name of the healthcare provider, the services rendered, and the dates of service. If possible, request itemized bills to have a clear breakdown of the charges.

Prescriptions and receipts

If you need to purchase medication during your trip, keep the prescription from the healthcare provider and retain the receipts for the medication purchases. These will serve as supporting documentation for your claim.

Doctor’s notes

If you visit a healthcare provider during your trip, request a detailed doctor’s note that provides information about the diagnosis and treatment received. This will help support your claim and provide evidence of the medical necessity of the expenses incurred.

Claiming for Trip Cancellations or Interruptions

If you need to cancel or cut short your trip due to unforeseen circumstances covered by your family travel insurance, here are the steps to follow when filing a claim.

Reasons for cancellation

Check your policy to understand the specific reasons for trip cancellation or interruption that are covered. Common covered reasons include serious illness or injury, the death of a family member, or a natural disaster at the destination.

Proof of trip cost

To support your claim for trip cancellation or interruption, you will need to provide proof of the non-refundable expenses incurred. This may include flight bookings, accommodation reservations, tour fees, and other pre-paid expenses.

Documentation for interruption

If you need to cut short your trip, ensure that you document the incident or circumstances that caused the interruption. For example, if you need to return home due to a family emergency, provide relevant documentation such as a letter from the healthcare provider or a death certificate.

Lost or Delayed Baggage Claims

If your baggage is lost, delayed, or stolen during your trip, you can file a claim with your family travel insurance to recoup the expenses associated with the loss or delay.

Notifying the airline

As soon as you become aware of the loss, delay, or theft of your baggage, notify the airline or travel provider immediately. They will provide you with a Property Irregularity Report (PIR), which you will need to include in your claim.

Claiming for belongings

To claim for lost or stolen belongings, provide a detailed list of the items, including their value, description, and any proof of purchase or ownership, such as receipts or photographs. If possible, provide evidence of the baggage contents, such as photographs taken before the trip.

Compensation limits

Keep in mind that there are usually limits to the compensation provided for lost or delayed baggage. Familiarize yourself with your policy’s limits and exclusions to understand what you are entitled to claim.

Emergency Assistance and Evacuation

In case of a medical emergency or other unforeseen circumstances during your trip, family travel insurance can provide emergency assistance and coverage for additional expenses.

Contacting the insurance provider

If you require emergency assistance or evacuation, contact your insurance provider’s emergency helpline immediately. They will guide you through the necessary steps and coordinate any required arrangements.

Arranging medical transportation

If you or a family member requires medical transportation or evacuation, the insurance provider can help arrange and cover the costs. This may include air ambulance services, repatriation to your home country, or transportation to the nearest healthcare facility.

Coverage for emergency expenses

Family travel insurance may provide coverage for additional expenses incurred during an emergency, such as accommodation for a family member accompanying the insured, or reimbursement for additional travel expenses to return home if the trip is interrupted due to the emergency.

Understanding Coverage Exclusions

While family travel insurance provides valuable coverage, it is important to understand the exclusions that may limit or restrict your coverage.

Pre-existing conditions

Most family travel insurance policies exclude coverage for pre-existing medical conditions unless they are specifically covered or additional coverage is purchased. Review the policy’s definition of pre-existing conditions and any available options for coverage.

Participating in risky activities

Engaging in risky activities, such as extreme sports or hazardous pursuits, may not be covered under your family travel insurance policy. Make sure to read the policy’s exclusions regarding activities and ensure that your planned activities are covered.

High-value items

Family travel insurance may have limits or exclusions for high-value items, such as jewelry, electronics, or expensive camera equipment. If you are traveling with valuable items, consider purchasing additional coverage or leaving them at home.

Exceptions for Unforeseen Circumstances

Family travel insurance provides coverage for unforeseen circumstances, but there are certain events that may be considered exceptions.

Natural disasters

While family travel insurance generally covers trip cancellations or interruptions due to natural disasters, some policies may have specific exclusions or limitations for certain types of natural disasters. Review your policy to ensure that you are covered for the destinations you plan to visit.

Terrorist attacks

Terrorist attacks may or may not be covered by family travel insurance, depending on the policy terms and conditions. Some policies may exclude coverage for acts of terrorism. Check your policy to understand the coverage for this particular risk.

Political unrest

Similar to terrorist attacks, coverage for trip cancellations or interruptions due to political unrest may vary depending on the policy. Review your policy to understand the coverage and any exclusions related to political unrest.

Dealing with Claim Denials

In some cases, your family travel insurance claim may be denied. If this happens, there are steps you can take to understand the denial reason and potentially appeal the decision.

Understanding the denial reason

Contact your insurance provider to understand the specific reason for the claim denial. Ask for a detailed explanation and review your policy to ensure that the denial is justified. If you still have questions or concerns, seek assistance from a licensed insurance agent or legal professional.

Appealing the decision

If you believe that the claim denial is unjustified, you can submit an appeal to your insurance provider. Compile any additional supporting documentation that may strengthen your case and submit it along with a written appeal. Follow up with the insurance provider and maintain open communication throughout the process.

Seeking legal assistance

If your claim denial is not resolved through the appeal process, you may consider seeking legal assistance. Consult with a lawyer specializing in insurance law to understand your rights and explore potential legal avenues.

Claims Assistance and Customer Support

When filing a claim with your family travel insurance, it is important to have access to reliable claims assistance and customer support.

Contacting the insurance company

Make sure to have the contact information of your insurance company readily available during your trip. This includes both the general customer service helpline and the dedicated claims helpline.

Claim helpline

If you need to file a claim, contact the dedicated claims helpline provided by your insurance company. They will guide you through the claims process and address any specific questions or concerns you may have.

Online support resources

Many insurance companies provide online support resources, such as FAQs, claims forms, and policy documents, on their websites. Take advantage of these resources to find answers to common questions and understand the claims process better.

Reviewing Policy Coverage and Renewals

To ensure that your family travel insurance coverage remains suitable for your needs, it is important to review your policy regularly and consider renewals or modifications.

Policy review checklist

Periodically review your family travel insurance policy to assess its adequacy. Consider factors such as changes in your family’s travel patterns, updated coverage needs, and any specific exclusions or limitations that may affect your coverage.

Renewal process

When your family travel insurance is due for renewal, review the renewal offer from your insurance provider carefully. Take note of any changes in coverage, premiums, or terms and conditions. Compare the renewal offer with other available policies to ensure that you continue to have the most suitable coverage.

Modifying coverage

If your family’s travel needs change, such as adding new family members or engaging in riskier activities, consider modifying your coverage accordingly. Contact your insurance provider to discuss the available options and ensure that your policy continues to meet your needs.

Conclusion

Family travel insurance plays a crucial role in providing financial protection and peace of mind during your travels. By understanding the coverage, claims process, and necessary documentation, you can effectively file claims and ensure a smooth experience in case of unexpected events. Remember to review and renew your family travel insurance regularly to ensure that you have the most suitable coverage for your needs. Safe travels!