In this article, you will learn about the potential risks and drawbacks of skipping family travel insurance. Traveling with your family can be an exciting and memorable experience, but it is important to protect yourself and your loved ones in case of unforeseen circumstances. By understanding the potential pitfalls of avoiding travel insurance, you can make an informed decision that will provide peace of mind during your trip.

One of the main risks of neglecting to purchase family travel insurance is the financial burden that you may face in case of an emergency or unexpected event. Without insurance, you are responsible for covering the costs of any medical expenses, trip cancellations, or lost belongings. This can result in significant financial strain and may even lead to debt. Additionally, travel insurance can offer assistance and support services, such as emergency medical evacuation or 24/7 customer support, which can be crucial in unfamiliar situations. By investing in travel insurance, you are safeguarding your family’s financial and physical well-being during your travels.

Understanding Family Travel Insurance

What is family travel insurance?

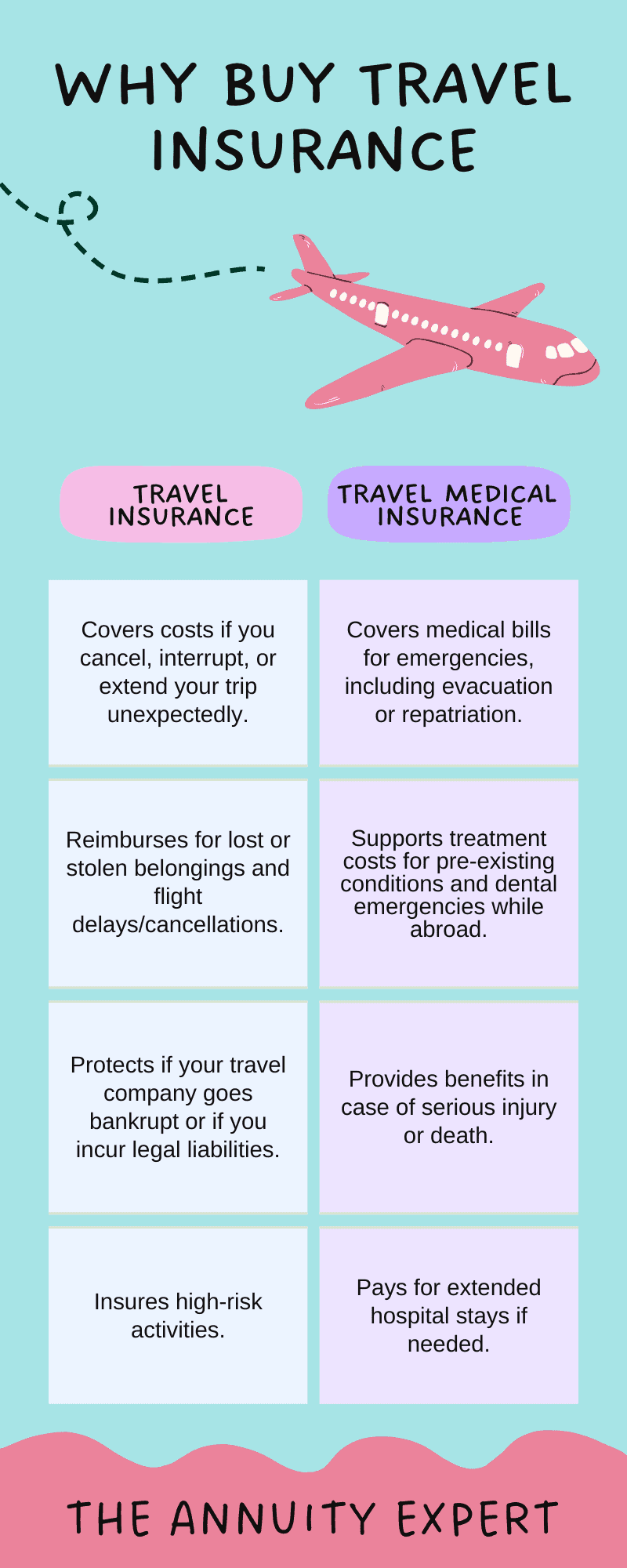

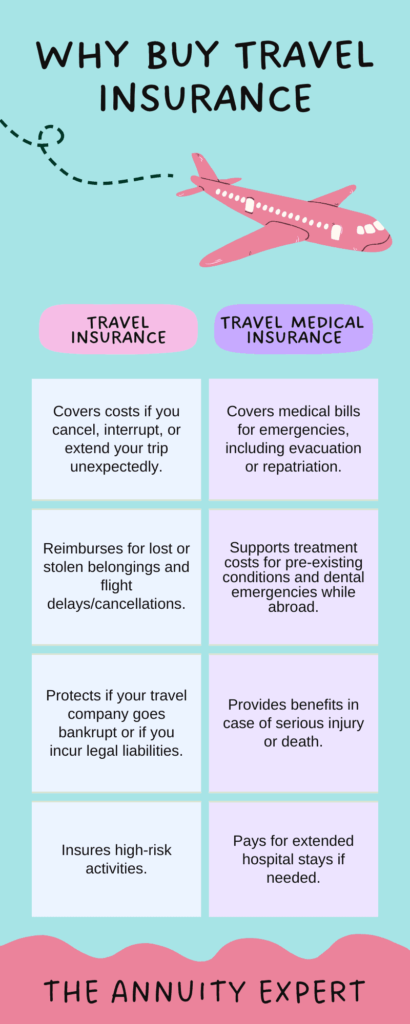

Family travel insurance is a type of insurance coverage that provides financial protection for families traveling together. It typically includes coverage for medical emergencies, trip cancellation or interruption, lost or stolen belongings, and other unforeseen events that may occur during a trip.

Importance of family travel insurance

Family travel insurance is important because it helps protect you and your loved ones from the financial consequences of unexpected events while traveling. It provides peace of mind knowing that you have financial protection in case of emergencies or unforeseen circumstances. Without insurance, the costs of medical treatments, trip cancellations, or lost belongings can be significant and can ruin your travel experience.

Financial Consequences of Skipping Family Travel Insurance

Costly medical expenses without insurance

One of the main risks of traveling without family travel insurance is the potential for costly medical expenses. In the event of a medical emergency, the cost of hospitalization, doctor’s fees, and any necessary medical treatments can quickly add up. Without insurance, you may have to pay these expenses out of pocket, which can place a significant financial burden on your family.

Additional expenses due to trip interruption or cancellation

Another financial consequence of skipping family travel insurance is the risk of trip interruption or cancellation. If you have to cut your trip short or cancel it altogether due to unforeseen circumstances such as illness, injury, or natural disasters, you may lose the money you have already spent on flights, accommodation, and other non-refundable expenses. With travel insurance, you can be reimbursed for these expenses and avoid substantial financial losses.

Risks Covered by Family Travel Insurance

Medical emergencies and hospitalization

Family travel insurance typically covers medical emergencies and hospitalization expenses. This includes coverage for doctor’s fees, hospital stays, surgery, medications, and other necessary medical treatments. Having this coverage ensures that you and your family receive the medical attention you need while away from home without worrying about the cost.

Loss, theft, or damage to personal belongings

Family travel insurance also provides coverage for loss, theft, or damage to personal belongings. This includes coverage for lost or stolen luggage, electronics, jewelry, and other valuable items. If any of your belongings are lost, stolen, or damaged during your trip, you can file a claim with your insurance provider to be reimbursed for their value or the cost of replacement.

Delayed or lost baggage

In addition to covering loss or theft of personal belongings, family travel insurance also typically includes coverage for delayed or lost baggage. If your luggage is delayed or lost by the airline, you can file a claim to receive compensation for essential items that you need to purchase while waiting for your baggage. This can help alleviate the stress and inconvenience caused by such situations.

Exclusions and Limitations of Family Travel Insurance

Pre-existing medical conditions

It is important to note that family travel insurance may have exclusions and limitations, such as coverage limitations for pre-existing medical conditions. Pre-existing conditions are illnesses or injuries that you or your family members have been diagnosed with before purchasing the insurance policy. It is crucial to disclose any pre-existing conditions to the insurance provider when obtaining a policy to ensure you have appropriate coverage or seek additional coverage if necessary.

Adventure or risky activities

Family travel insurance may also have limitations on coverage for adventure or risky activities. Activities such as skydiving, bungee jumping, or scuba diving may not be covered by standard travel insurance policies. If you plan to engage in these activities during your trip, it is important to check if your insurance policy provides coverage or if you need to purchase additional coverage specifically for these activities.

Duration and destination restrictions

Some family travel insurance policies may have restrictions on the duration of coverage or the destinations they cover. For example, certain policies may have a maximum trip duration of 30 days or exclude coverage for travel to certain countries with higher risks. It is important to carefully read and understand the policy terms and conditions to ensure that your travel plans fall within the coverage limitations.

Legal Considerations

Liability for third-party injuries or damages

In addition to financial protection, family travel insurance may also provide liability coverage for any third-party injuries or damages caused by you or your family members during your trip. Accidents can happen, and if you are found liable for causing harm to others or damaging property, the insurance coverage can help cover the associated legal expenses and potential compensation.

Legal assistance and support

In situations where legal assistance is required during your trip, family travel insurance may provide access to legal support services. This can include assistance with navigating local laws and regulations, obtaining legal advice, and coordinating with legal representatives in case of emergencies or unforeseen legal issues. Having this support can be invaluable, especially when traveling to unfamiliar destinations.

Importance of Pre-Existing Medical Conditions

Declaration of pre-existing medical conditions

When purchasing family travel insurance, it is crucial to declare any pre-existing medical conditions. Failure to disclose these conditions can result in the denial of coverage for related medical expenses if you or your family members require emergency medical treatment during your trip. By accurately declaring pre-existing conditions, you can ensure that you have appropriate coverage and avoid any potential pitfalls in the event of a medical emergency.

Coverage for emergency medical treatment

Family travel insurance provides coverage for emergency medical treatment needed during your trip. This can include coverage for doctor’s visits, hospital stays, emergency surgeries, medications, and other necessary medical treatments. Having coverage for emergency medical treatment can give you peace of mind knowing that you and your family will receive the care you need without worrying about the cost.

Emergency Medical Evacuation and Repatriation

Arranging emergency medical evacuation

In the event of a medical emergency that requires specialized care not available at your travel destination, family travel insurance can cover the cost of emergency medical evacuation. This involves arranging for transportation to the nearest appropriate medical facility or back to your home country for treatment. Medical evacuations can be extremely costly, and having insurance coverage can save you from significant financial burdens.

Repatriation of remains in case of death

In the unfortunate event of a family member’s death during your trip, family travel insurance can provide coverage for the repatriation of their remains. This includes covering the costs associated with transporting the deceased back to their home country for burial or funeral arrangements. Having this coverage can help ease the financial burden on your family during a difficult time.

Travel Assistance and 24/7 Support

Access to travel assistance helpline

Family travel insurance often includes access to a travel assistance helpline, which can provide support and guidance in various situations. The helpline is available 24/7 and can assist with emergencies, medical referrals, travel advice, language translation services, lost travel documents, and other travel-related concerns. Having access to this helpline can be invaluable, especially when dealing with unfamiliar situations or locations.

Support for lost travel documents or passport

Losing your travel documents or passport can be a stressful experience while traveling. With family travel insurance, you can receive support and assistance in replacing these documents. The insurance provider can help you navigate the process of getting new travel documents, providing you with the necessary guidance and support to minimize inconvenience and potential delays.

Importance of Trip Cancellation Coverage

Reimbursement for non-refundable expenses

One of the important benefits of family travel insurance is trip cancellation coverage. If you need to cancel your trip due to unforeseen circumstances, such as illness, injury, or unexpected events, the insurance can provide reimbursement for non-refundable expenses. This can include flight tickets, hotel reservations, tour bookings, and other pre-paid expenses. Having trip cancellation coverage can protect your investment in the trip and prevent financial losses.

Protection against unforeseen circumstances

Family travel insurance also provides protection against unforeseen circumstances that may disrupt or interrupt your trip. This can include coverage for trip delay, missed connections, or trip rescheduling due to airline strikes, natural disasters, or other events beyond your control. With this coverage, you can be reimbursed for any additional expenses incurred as a result of these unforeseen circumstances.

Family Travel Insurance vs. Individual Coverage

Benefits of family travel insurance

Opting for family travel insurance instead of individual coverage offers several benefits. Firstly, it provides coverage for all family members traveling together, including spouses, children, and sometimes even grandparents or extended family members. This eliminates the need to purchase separate policies for each family member, saving time and potentially reducing costs. Additionally, family travel insurance typically offers higher coverage limits and more comprehensive benefits compared to individual policies.

Comparison of cost and coverage

When comparing the cost and coverage of family travel insurance to individual policies, it is important to consider the number of individuals covered, the duration of the trip, and the destinations included. While family travel insurance may initially seem more expensive, it often provides better value overall, considering the coverage provided for multiple family members and a wider range of potential risks and travel-related events.

Tips for Choosing a Family Travel Insurance Plan

Evaluate coverage limits and exclusions

When choosing a family travel insurance plan, it is important to carefully evaluate the coverage limits and exclusions. Check the maximum coverage amounts for medical expenses, trip cancellation or interruption, lost belongings, and other covered risks. Additionally, review the policy’s exclusions to ensure that there are no limitations that could potentially leave you underinsured or without coverage for specific circumstances that are important to your family’s travel plans.

Read and understand policy terms and conditions

Before purchasing family travel insurance, take the time to read and understand the policy terms and conditions. Pay attention to the fine print, including any restrictions or requirements for making claims, cancellation policies, and any additional services or benefits included with the policy. Make sure you are comfortable with the terms and conditions before committing to a specific insurance plan.

Common Mistakes When Buying Family Travel Insurance

Failing to disclose pre-existing conditions

One common mistake when buying family travel insurance is failing to disclose pre-existing medical conditions. It is essential to provide accurate and complete information about any pre-existing conditions for all family members who will be covered under the policy. Failing to disclose these conditions can result in the denial of coverage for related medical expenses and potential difficulties when making a claim.

Assuming credit card coverage is sufficient

Another common mistake is assuming that credit card travel insurance coverage is sufficient. While some credit cards offer travel insurance as a perk, the coverage may be limited in scope or may not provide the same comprehensive benefits as dedicated travel insurance policies. It is important to review the coverage provided by your credit card and consider purchasing additional travel insurance if the coverage is not adequate for your family’s needs.

Real-Life Examples of the Consequences

Personal stories of families without insurance

There have been countless personal stories of families who traveled without insurance and experienced significant financial hardships as a result. These families found themselves facing high medical bills after unexpected injuries or illnesses occurred during their trips. Without insurance to cover the costs, they were left struggling to pay for medical treatments and other related expenses, causing significant stress and financial strain.

Financial hardships faced due to unforeseen events

Unforeseen events can happen to anyone, regardless of how well-planned a trip may be. Families without travel insurance have faced financial hardships due to events such as trip cancellations due to natural disasters, lost or stolen belongings, or medical emergencies that required hospitalization or emergency evacuation. These events can result in unexpected expenses that can quickly deplete savings or cause debt, highlighting the importance of having appropriate travel insurance coverage.

Conclusion

Family travel insurance is not something to be overlooked or taken lightly. It provides crucial financial protection for you and your loved ones while traveling, ensuring that unforeseen events do not derail your trip or leave you facing financial hardship. Investing in family travel insurance can save you from potential pitfalls, allowing you to focus on creating lasting memories and enjoying your time together as a family. Don’t let the cost of insurance discourage you; the peace of mind and protection it provides are priceless when it comes to the well-being of your family during your travels.